Question: Operating Costs: Variable costs are projected at 2 0 % of sales, and fixed operating costs of $ 8 0 million annually. Maintenance Expenses: Maintenance

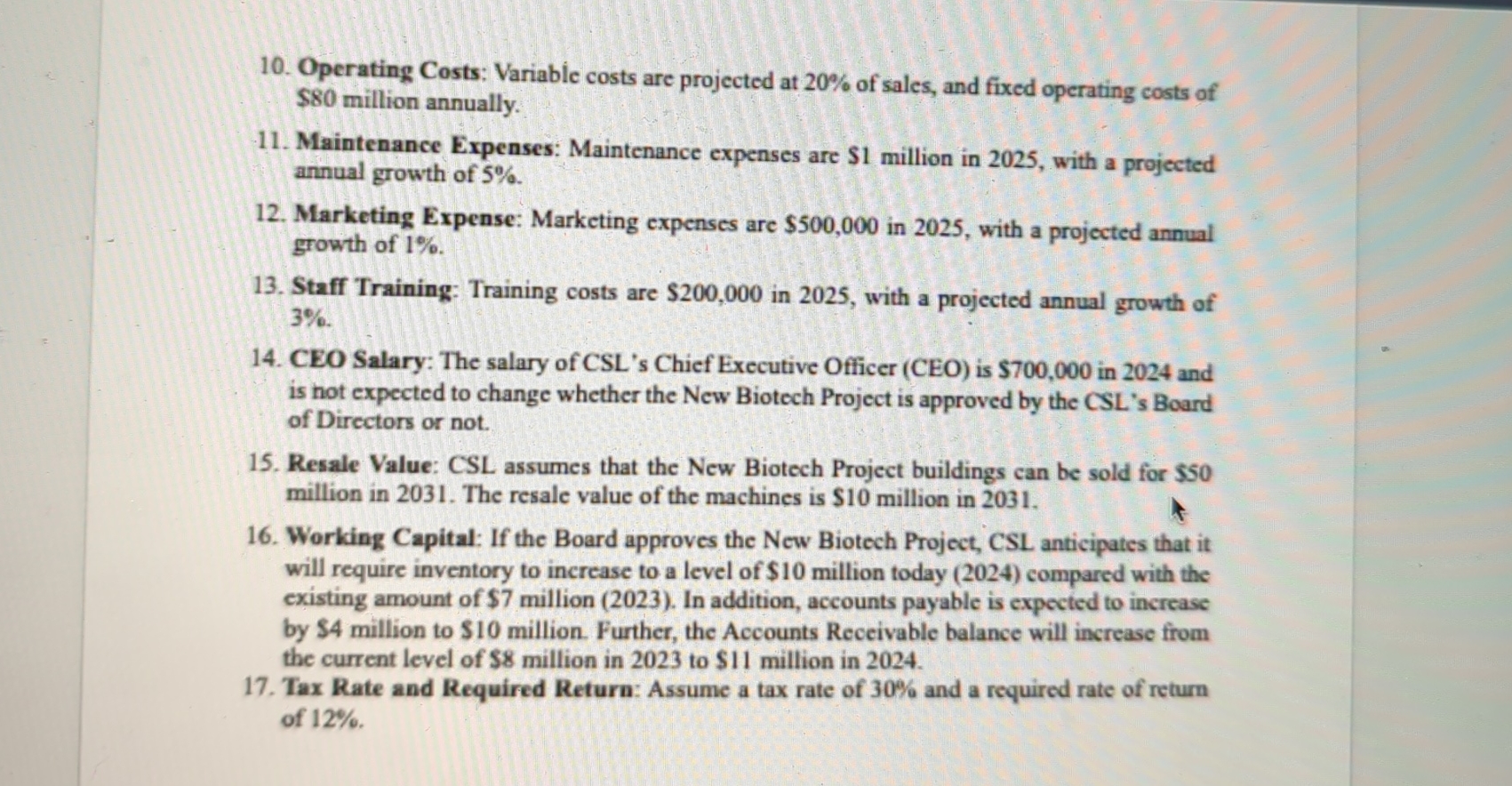

Operating Costs: Variable costs are projected at of sales, and fixed operating costs of $ million annually.

Maintenance Expenses: Maintenance expenses are $ million in with a projected annual growth of

Marketing Expense: Marketing expenses are $ in with a projected annual growth of

Staff Training: Training costs are $ in with a projected annual growth of

CEO Salary: The salary of CSLs Chief Executive Officer CEO is $ in and is not expected to change whether the New Biotech Project is approved by the CSLs Board of Directors or not.

Resale Value: CSL assumes that the New Biotech Project buildings can be sold for $ million in The resale value of the machines is $ million in

Working Capital: If the Board approves the New Biotech Project, CSL anticipates that it will require inventory to increase to a level of $ million today compared with the existing amount of $ million In addition, accounts payable is expected to increase by $ million to $ million. Further, the Accounts Receivable balance will increase from the current level of $ million in to $ million in

Tax Rate and Required Return: Assume a tax rate of and a required rate of return of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock