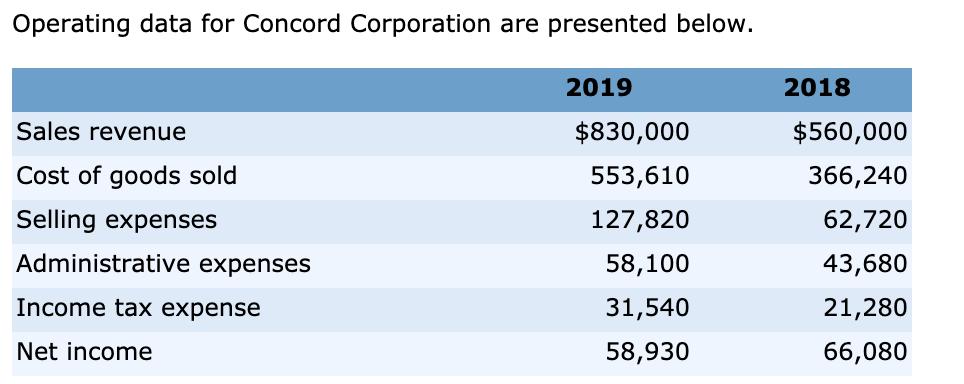

Question: Operating data for Concord Corporation are presented below. 2019 2018 Sales revenue $830,000 $560,000 Cost of goods sold 553,610 366,240 Selling expenses 127,820 62,720

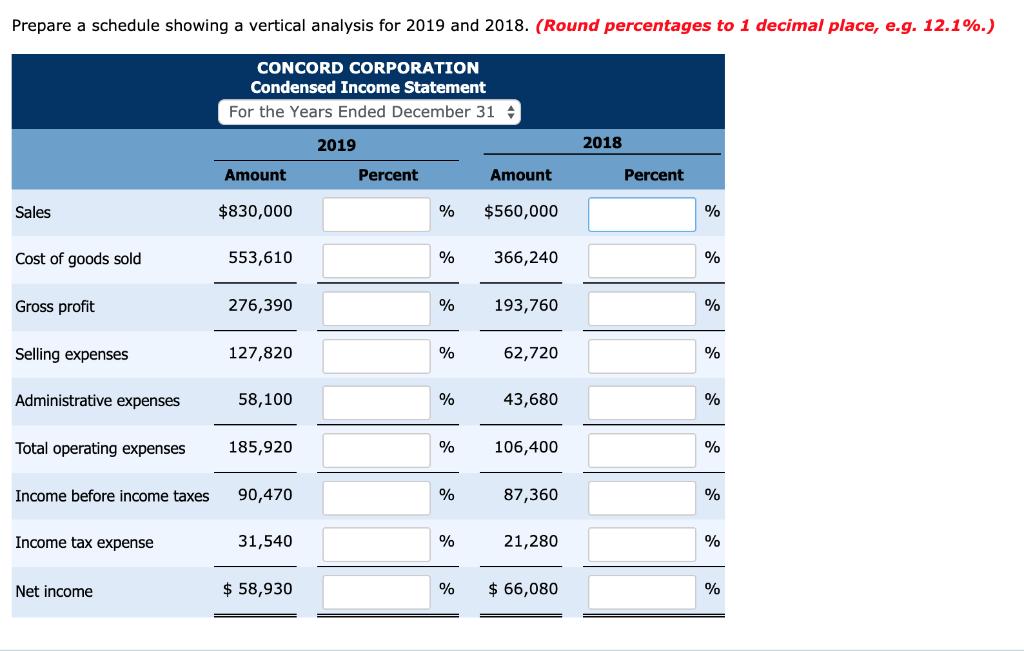

Operating data for Concord Corporation are presented below. 2019 2018 Sales revenue $830,000 $560,000 Cost of goods sold 553,610 366,240 Selling expenses 127,820 62,720 Administrative expenses 58,100 43,680 Income tax expense 31,540 21,280 Net income 58,930 66,080 Prepare a schedule showing a vertical analysis for 2019 and 2018. (Round percentages to 1 decimal place, e.g. 12.1%.) CONCORD CORPORATION Condensed Income Statement For the Years Ended December 31 2019 2018 Amount Percent Amount Percent Sales $830,000 % $560,000 % Cost of goods sold 553,610 % 366,240 % Gross profit 276,390 % 193,760 % Selling expenses 127,820 % 62,720 % Administrative expenses 58,100 % 43,680 % Total operating expenses 185,920 % 106,400 % Income before income taxes 90,470 % 87,360 % Income tax expense 31,540 % 21,280 % Net income $ 58,930 % $ 66,080 %

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

CONCORD CORPORATION 2019 2018 Amount Percent Amount Percent Sales 830000 10000 56000... View full answer

Get step-by-step solutions from verified subject matter experts