Question: - Operating Leverage = Fixed Costs Total Costs - Fixed costs are those that will not change for 1 to 2 years or longer, such

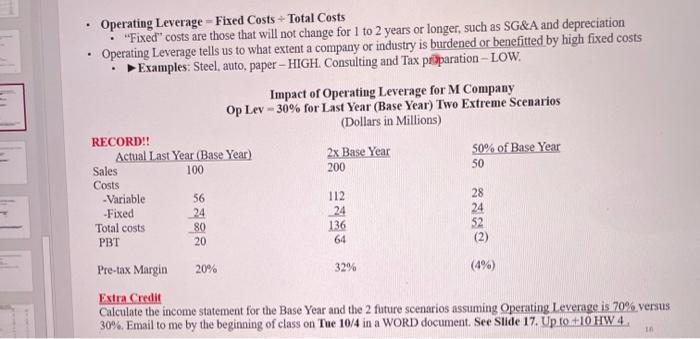

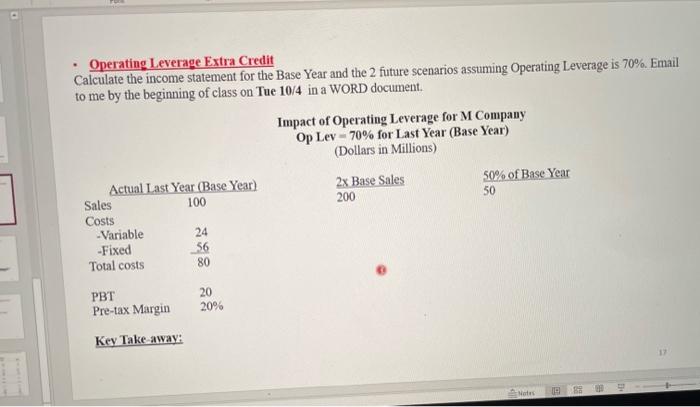

- Operating Leverage = Fixed Costs Total Costs - "Fixed" costs are those that will not change for 1 to 2 years or longer, such as SG\&A and depreciation - Operating Leverage tells us to what extent a company or industry is burdened or benefitted by high fixed costs - Examples: Steel, auto, paper-HIGH. Consulting and Tax priparation-LOW. Impact of Operating Leverage for M Company Op Lev =30% for Last Year (Base Year) Two Extreme Scenarios (Dollars in Millions) Extra Credit Calculate the income statement for the Base Year and the 2 future scenarios assuming Operating Leverage is 70% versus 30%. Email to me by the beginning of class on Tue 10/4 in a WORD document. See Slide 17. Up to +10 HW 4 - Operating Leverage Extra Credit Calculate the income statement for the Base Year and the 2 future scenarios assuming Operating Leverage is 70%. Email to me by the beginning of class on Tue 10/4 in a WORD document. Impact of Operating Leverage for M Company Op Lev =70% for Last Year (Base Year) (Dollars in Millions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts