Question: Optimal Capital Structure 24) Optimal capital structure (15 points) QMartExpress paid an annual dividend of $2.5/share this year. The firm's common stock dividends grow at

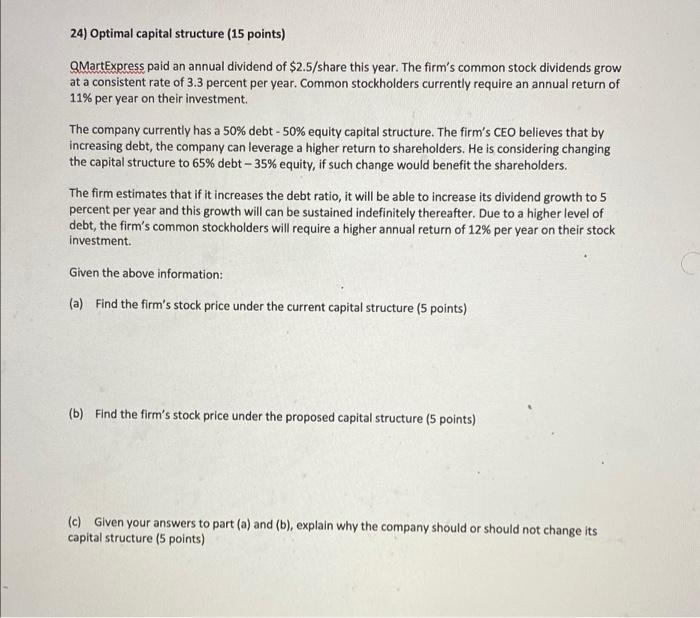

24) Optimal capital structure (15 points) QMartExpress paid an annual dividend of $2.5/share this year. The firm's common stock dividends grow at a consistent rate of 3.3 percent per year. Common stockholders currently require an annual return of 11% per year on their investment The company currently has a 50% debt - 50% equity capital structure. The firm's CEO believes that by increasing debt, the company can leverage a higher return to shareholders. He is considering changing the capital structure to 65% debt -35% equity, if such change would benefit the shareholders. The firm estimates that if it increases the debt ratio, it will be able to increase its dividend growth to 5 percent per year and this growth will can be sustained indefinitely thereafter. Due to a higher level of debt, the firm's common stockholders will require a higher annual return of 12% per year on their stock investment. Given the above information: (a) Find the firm's stock price under the current capital structure (5 points) (b) Find the firm's stock price under the proposed capital structure (5 points) (c) Given your answers to part (a) and (b), explain why the company should or should not change its capital structure (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts