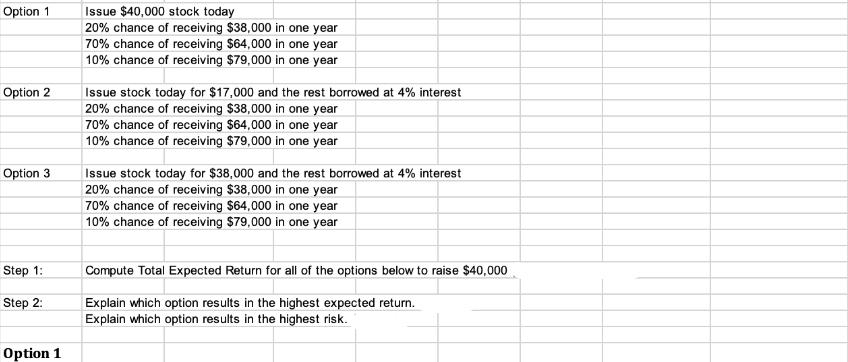

Question: Option 1 Option 2 Option 3 Step 1: Step 2: Option 1 Issue $40,000 stock today 20% chance of receiving $38,000 in one year

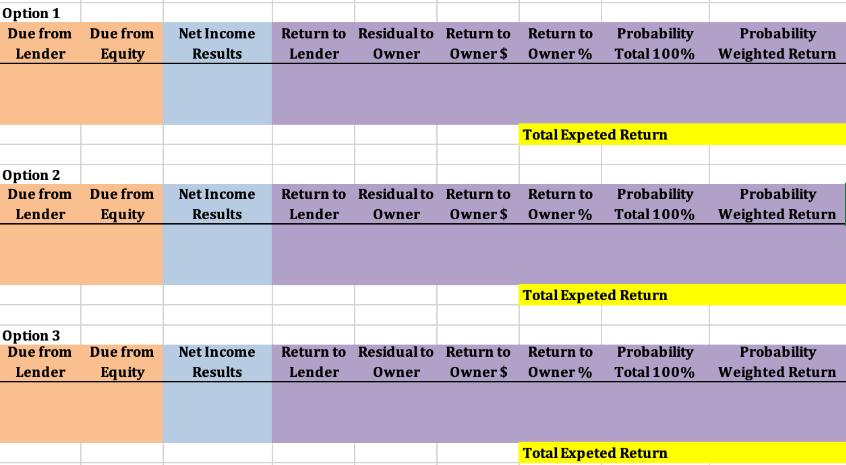

Option 1 Option 2 Option 3 Step 1: Step 2: Option 1 Issue $40,000 stock today 20% chance of receiving $38,000 in one year 70% chance of receiving $64,000 in one year 10% chance of receiving $79,000 in one year Issue stock today for $17,000 and the rest borrowed at 4% interest 20% chance of receiving $38,000 in one year 70% chance of receiving $64,000 in one year 10% chance of receiving $79,000 in one year Issue stock today for $38,000 and the rest borrowed at 4% interest 20% chance of receiving $38,000 in one year 70% chance of receiving $64,000 in one year 10% chance of receiving $79,000 in one year Compute Total Expected Return for all of the options below to raise $40,000 Explain which option results in the highest expected return. Explain which option results in the highest risk. Option 1 Due from Due from Equity Lender Option 2 Due from Due from Lender Equity Option 3 Due from Due from Lender Equity Net Income Results Net Income Results Net Income Results Return to Residual to Lender Owner Return to Residual to Lender Owner Return to Residual to Lender Owner Return to Owner $ Return to Owner $ Return to Owner $ Return to Owner % Total Expeted Return Return to Owner % Probability Total 100% Return to Owner % Probability Total 100% Total Expeted Return Probability Total 100% Total Expeted Return Probability Weighted Return Probability Weighted Return Probability Weighted Return

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Option 1 Due from equity 40000 Net income results 20 chance of 38000 70 chance of 64000 ... View full answer

Get step-by-step solutions from verified subject matter experts