Question: Option B has a lower future value at Year 5. Both options are of equal value. Question 14 5 pts Assume two annuities will each

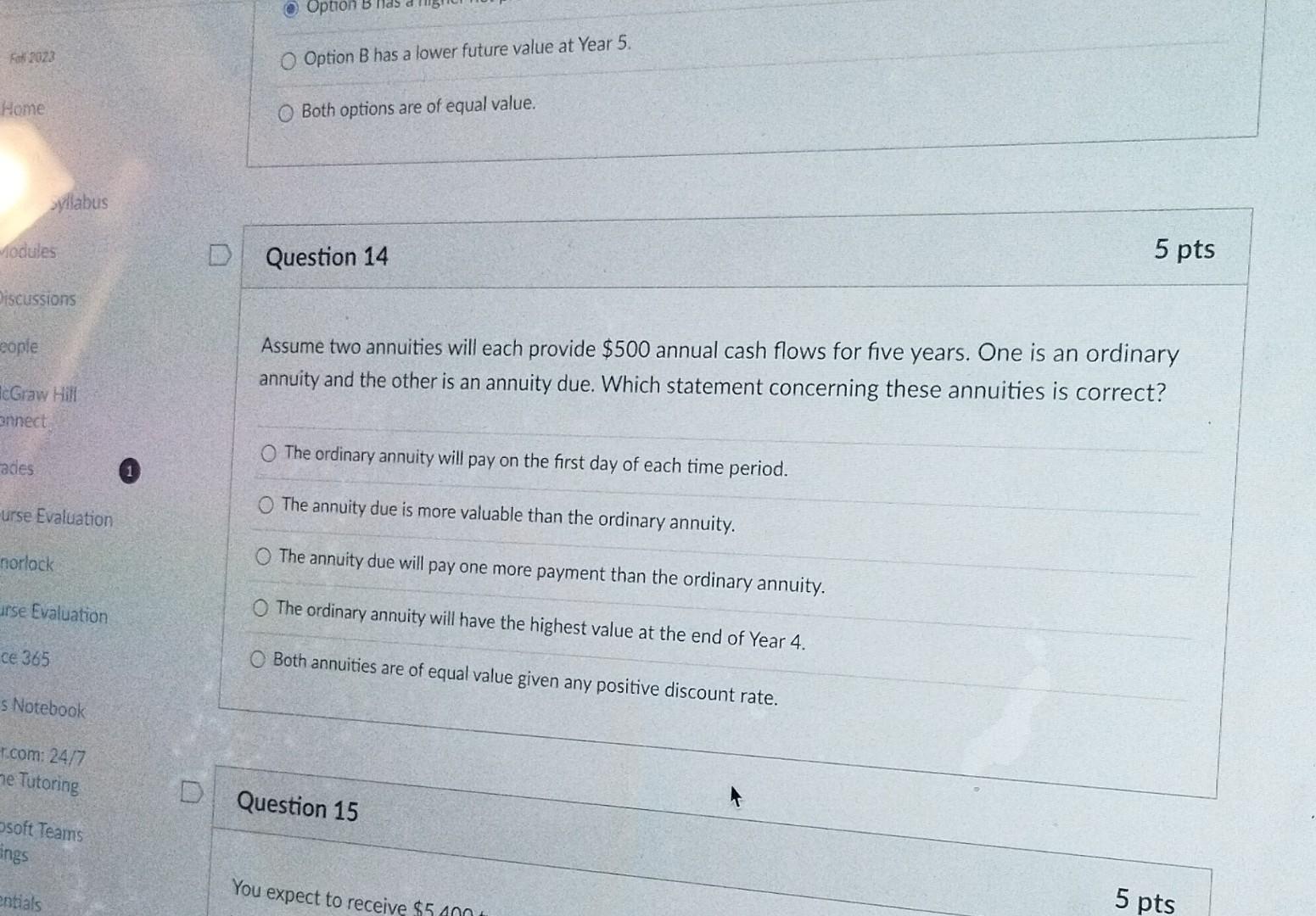

Option B has a lower future value at Year 5. Both options are of equal value. Question 14 5 pts Assume two annuities will each provide $500 annual cash flows for five years. One is an ordinary annuity and the other is an annuity due. Which statement concerning these annuities is correct? The ordinary annuity will pay on the first day of each time period. The annuity due is more valuable than the ordinary annuity. The annuity due will pay one more payment than the ordinary annuity. The ordinary annuity will have the highest value at the end of Year 4. Both annuities are of equal value given any positive discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts