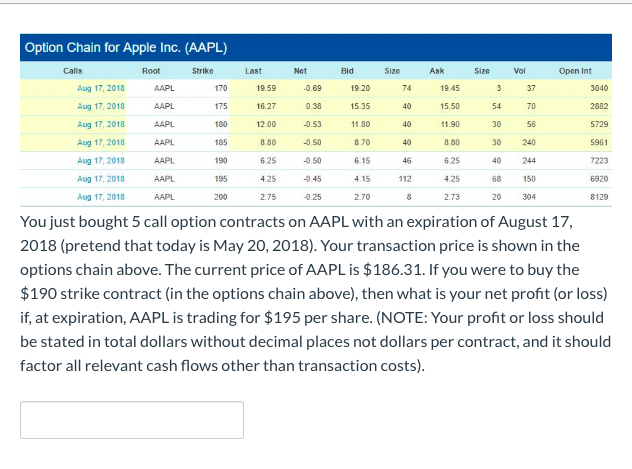

Question: Option Chain for Apple Inc. (AAPL) Root AAPL AAPL Calls Aug 17, 2018 Aug 17, 2018 Aug 17, 2018 Aug 17, 2018 Aug 17, 2018

Option Chain for Apple Inc. (AAPL) Root AAPL AAPL Calls Aug 17, 2018 Aug 17, 2018 Aug 17, 2018 Aug 17, 2018 Aug 17, 2018 Aug 17, 2018 Aug 17, 2018 Strike Last 170 19.59 175 16.27 180 12.00 8.80 1906.25 195 4 .25 2 00 2.75 AAPL AAPL Net -0.69 0.38 -0.53 -0.50 -0.50 0.45 -0.25 Bid 19.20 15.35 11.80 8.70 6.15 4.15 2.70 Size 74 4 0 40 40 46 112 Ask 19.45 15.50 11.90 8.80 6.25 4.25 2.73 Size Vol 3 37 54 70 3 0 56 30 240 40244 68 150 20 304 Open Int 3040 2682 5729 5961 185 AAPL AAPL AAPL 7223 6920 APL 8129 You just bought 5 call option contracts on AAPL with an expiration of August 17, 2018 (pretend that today is May 20, 2018). Your transaction price is shown in the options chain above. The current price of AAPL is $186.31. If you were to buy the $190 strike contract (in the options chain above), then what is your net profit (or loss) if, at expiration, AAPL is trading for $195 per share. (NOTE: Your profit or loss should be stated in total dollars without decimal places not dollars per contract, and it should factor all relevant cash flows other than transaction costs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts