Question: Option Chain for Apple Inc. (AAPL) Ask Vol Open Int Root Strike Puts Last Chg Bid Ask Vol Open Int Calls Last Chg Bid Aug

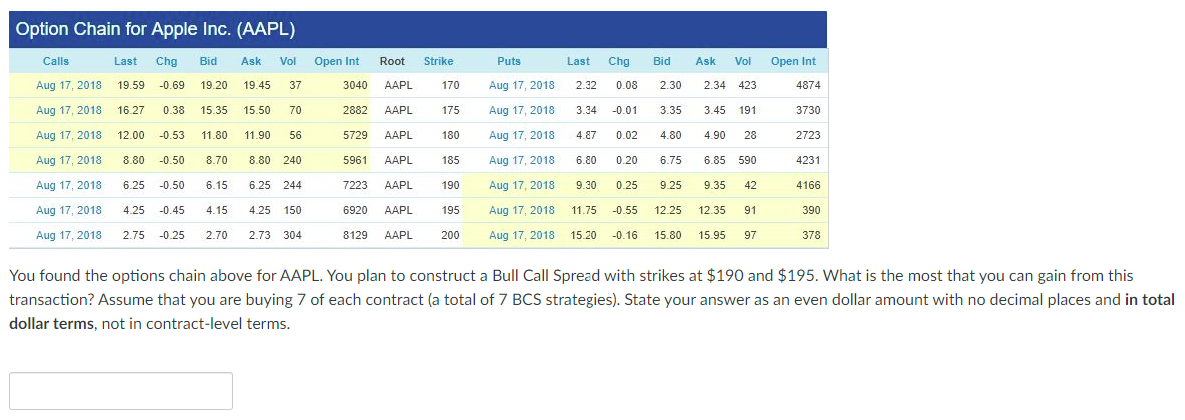

Option Chain for Apple Inc. (AAPL) Ask Vol Open Int Root Strike Puts Last Chg Bid Ask Vol Open Int Calls Last Chg Bid Aug 17, 2018 19.59 -0.69 19.20 Aug 17, 2018 16.27 0.38 15.35 19.45 37 3040 AAPL 170 Aug 17, 2018 2.32 0.08 2.30 2.34 423 4874 15.50 70 2882 AAPL 175 Aug 17, 2018 3.34 -0.01 3.35 3.45 191 3730 Aug 17, 2018 12.00 -0.53 11.80 11.90 56 5729 AAPL 180 Aug 17, 2018 4.87 0.02 4.80 4.90 28 2723 Aug 17, 2018 8.80 -0.50 8.70 8.80 240 5961 AAPL 185 Aug 17, 2018 6.80 0.20 6.75 6.85 590 4231 Aug 17, 2018 6.25 -0.50 6.15 6.25 244 7223 AAPL 190 Aug 17, 2018 9.30 0.25 9.25 9.35 42 4166 Aug 17, 2018 4.25 -0.45 4.15 4.25 150 6920 AAPL 195 Aug 17, 2018 11.75 -0.55 12.25 12.35 91 390 Aug 17, 2018 2.75 -0.25 2.70 2.73 304 8129 AAPL 200 Aug 17, 2018 15.20 -0.16 15.80 15.95 97 378 You found the options chain above for AAPL. You plan to construct a Bull Call Spread with strikes at $190 and $195. What is the most that you can gain from this transaction? Assume that you are buying 7 of each contract (a total of 7 BCS strategies). State your answer as an even dollar amount with no decimal places and in total dollar terms, not in contract-level terms. Option Chain for Apple Inc. (AAPL) Ask Vol Open Int Root Strike Puts Last Chg Bid Ask Vol Open Int Calls Last Chg Bid Aug 17, 2018 19.59 -0.69 19.20 Aug 17, 2018 16.27 0.38 15.35 19.45 37 3040 AAPL 170 Aug 17, 2018 2.32 0.08 2.30 2.34 423 4874 15.50 70 2882 AAPL 175 Aug 17, 2018 3.34 -0.01 3.35 3.45 191 3730 Aug 17, 2018 12.00 -0.53 11.80 11.90 56 5729 AAPL 180 Aug 17, 2018 4.87 0.02 4.80 4.90 28 2723 Aug 17, 2018 8.80 -0.50 8.70 8.80 240 5961 AAPL 185 Aug 17, 2018 6.80 0.20 6.75 6.85 590 4231 Aug 17, 2018 6.25 -0.50 6.15 6.25 244 7223 AAPL 190 Aug 17, 2018 9.30 0.25 9.25 9.35 42 4166 Aug 17, 2018 4.25 -0.45 4.15 4.25 150 6920 AAPL 195 Aug 17, 2018 11.75 -0.55 12.25 12.35 91 390 Aug 17, 2018 2.75 -0.25 2.70 2.73 304 8129 AAPL 200 Aug 17, 2018 15.20 -0.16 15.80 15.95 97 378 You found the options chain above for AAPL. You plan to construct a Bull Call Spread with strikes at $190 and $195. What is the most that you can gain from this transaction? Assume that you are buying 7 of each contract (a total of 7 BCS strategies). State your answer as an even dollar amount with no decimal places and in total dollar terms, not in contract-level terms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts