Question: Option pricing methodology is often used in complex real project valuations which allow for business investment opportunities throughout the life-time of the project. Using a

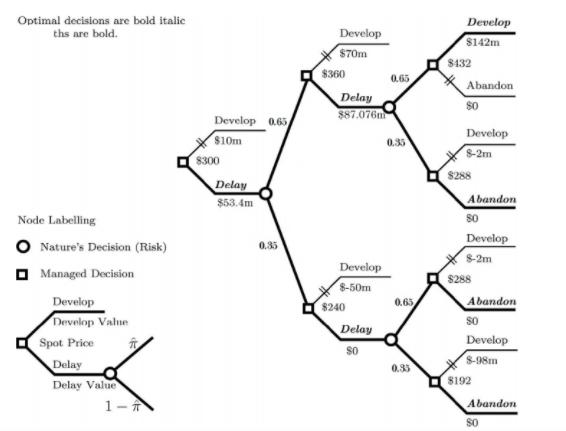

Option pricing methodology is often used in complex real project valuations which allow for business investment opportunities throughout the life-time of the project. Using a simple net present value (NPV) analysis for these projects may lead an incorrect valuation because NPV does not account for flexibility of investment options. Here is a specific example inspired by the article Sick and Gamba (2010). Suppose you are a consultant hired by a local government. The government needs to raise some cash now and hired you to determine the proper value of a three-year development concession for a specific gold-mine which has 1 million ounces of gold reserves. It is known from past practices that the gold can all be immediately produced in the year when the investment is made for a combined capital and operating cost of $290 million (this amount does not change within the three years). It is costly to store gold and it needs to be sold immediately after it is produced. Abstract from any additional financial instruments which can be used for hedging as if they are fairly priced they will not improve our real option. A company who purchases the concession will have the right to develop the mine for the period of concession and will bear no additional tax obligations. An initial gold price is $300 per ounce. From the analysis of historical data you know that gold price will rise by 20% over a year with a probability of 0.65 and it will fall by 20% with a probability of 0.35. The riskless discount rate is 6% and the company has can develop now, or defer for either one or two years, after which point the opportunity to invest is lost (concession expires). The government asked you to produce valuation of this project from the perspective of the company (not including the concession fee since its value is not decided yet). You were asked to assume that the company is risk-neutral.

Produce the figure above to explain your reasoning. It is analogous to American option pricing. If immediately developed, the NPV of the project is $10 million, but because the concession is valid for three periods (including period 0), the government should charge a higher fee.

1. What is the maximum fee the government should charge for the concession?

2. The contact person in the government, who recently studied Economic of Finance, wants you to be more explicit about your calculations. In particular you are asked to produce atomic prices for all future time-states g, b, gg, gb, bg, bb and calculate the maximum value of the project using these atomic prices and future payments. There are several ways to do this. You are free to use any method (incl. making use of risk-neutrality).

3. Discuss how the atomic prices and the project valuation would change (qualitatively, not the exact numbers), if the company was actually risk-averse rather than risk neutral.

Optimal decisions are bold italic ths are bold. Node Labelling O Nature's Decision (Risk) Managed Decision Develop Develop Value Spot Price Delay Delay Value 1- Develop 0.65 $10m 8300 Delay $53.4m 0.35 Develop $70m $360 Delay $87.076m Develop 8-50m 8240 Delay SO 0.65 0.35 0.65 0.35 Develop $142m 8432 Abandon $0 Develop 8-2m $288 Abandon 80 Develop $-2m $288 Abandon $0 Develop 8-98m 8192 Abandon 80

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

ANSWER 1 The framework developed after examining the fee regulatory guidelineslawsacts adopted by different State aims to provide a preventive strateg... View full answer

Get step-by-step solutions from verified subject matter experts