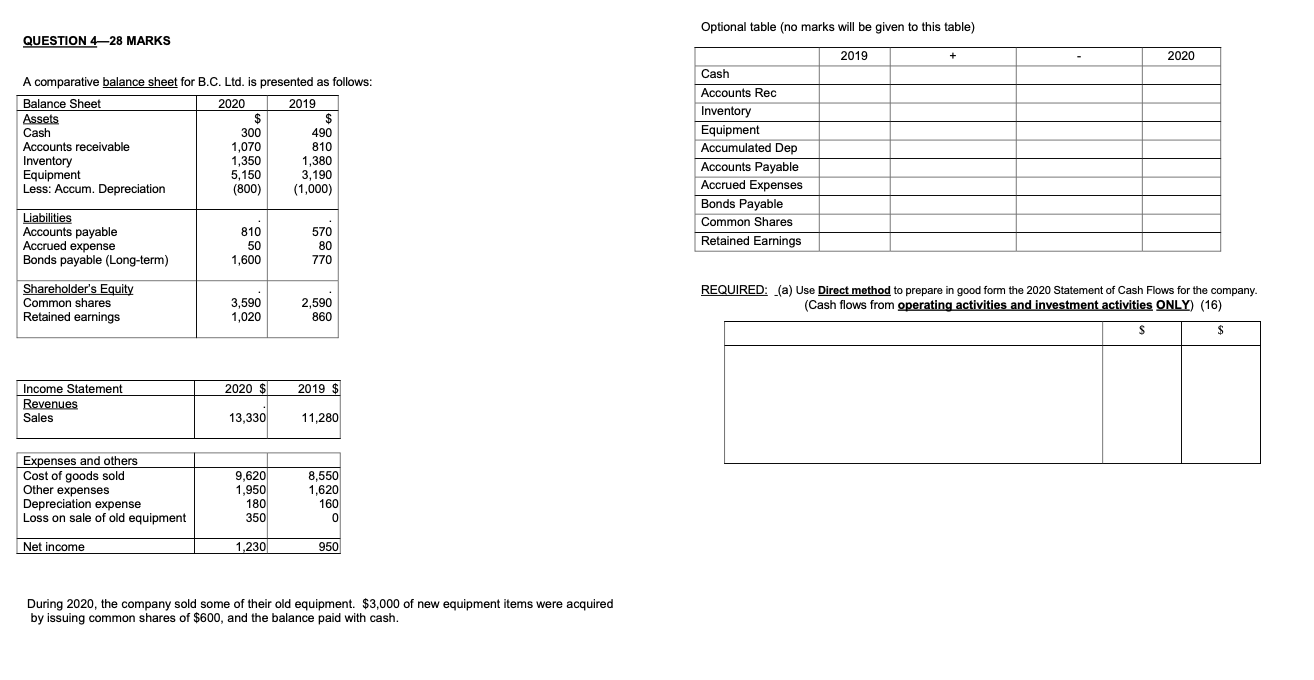

Question: Optional table (no marks will be given to this table) QUESTION 428 MARKS 2019 2020 A comparative balance sheet for B.C. Ltd. is presented as

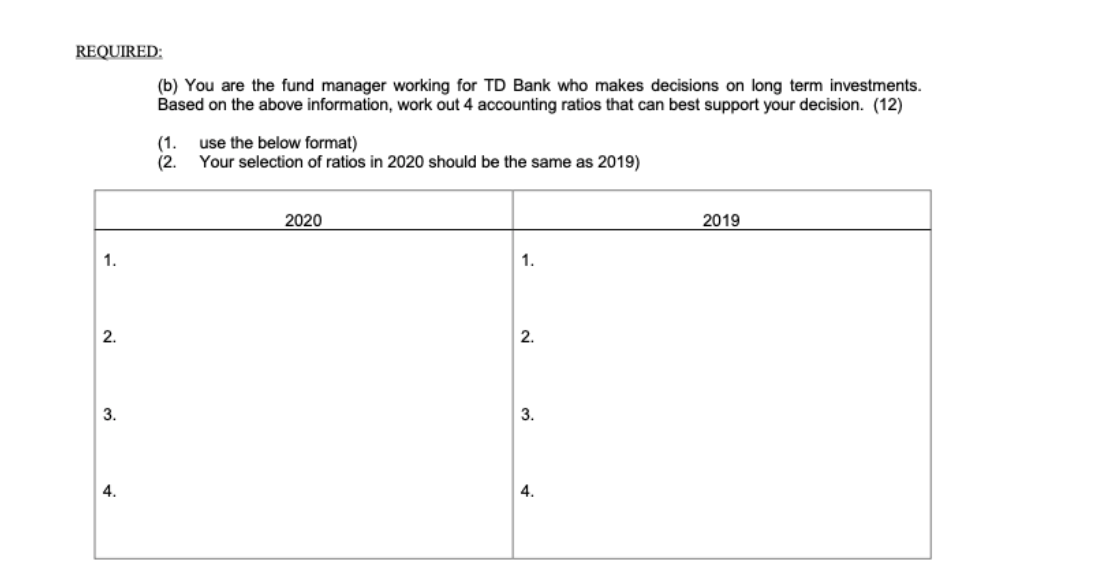

Optional table (no marks will be given to this table) QUESTION 428 MARKS 2019 2020 A comparative balance sheet for B.C. Ltd. is presented as follows: Balance Sheet 2020 2019 Assets $ $ Cash 300 490 Accounts receivable 1,070 810 Inventory 1,350 1,380 Equipment 5,150 3,190 Less: Accum. Depreciation (800) (1,000) Cash Accounts Rec Inventory Equipment Accumulated Dep Accounts Payable Accrued Expenses Bonds Payable Common Shares Retained Earnings Liabilities Accounts payable Accrued expense Bonds payable (Long-term) 810 50 1,600 570 80 770 Shareholder's Equity Common shares Retained earnings 3,590 1,020 2,590 860 REQUIRED: (a) Use Direct method to prepare in good for the 2020 Statement of Cash Flows for the company. (Cash flows from operating activities and investment activities ONLY) (16) $ $ 2020 $ 2019 $ Income Statement Revenues Sales 13,330 11,280 Expenses and others Cost of goods sold Other expenses Depreciation expense Loss on sale of old equipment 9,620 1,950 180 350 8,550 1,620 160 0 Net income 1,230 950 During 2020, the company sold some of their old equipment. $3,000 of new equipment items were acquired by issuing common shares of $600, and the balance paid with cash. REQUIRED (b) You are the fund manager working for TD Bank who makes decisions on long term investments. Based on the above information, work out 4 accounting ratios that can best support your decision. (12) (1. (2. use the below format) Your selection of ratios in 2020 should be the same as 2019) 2020 2019 1. 1. 2. 2. 3. 3. 4. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts