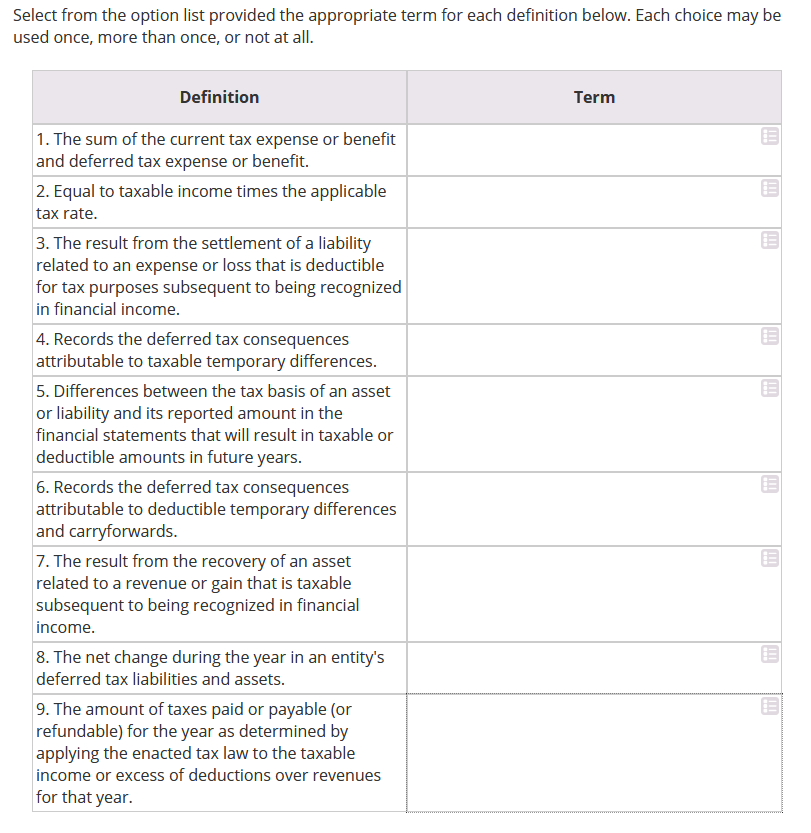

Question: Options are: * Permanent Differences * Temporary Differences * Deferred Tax Asset * Deferred Tax Liability * Deferred Tax Expense or Benefit * Current Tax

Options are:

* Permanent Differences

* Temporary Differences

* Deferred Tax Asset

* Deferred Tax Liability

* Deferred Tax Expense or Benefit

* Current Tax Liability

Select from the option list provided the appropriate term for each definition below. Each choice may be used once, more than once, or not at all. Definition Term 1. The sum of the current tax expense or benefit and deferred tax expense or benefit. 2. Equal to taxable income times the applicable tax rate. 3. The result from the settlement of a liability related to an expense or loss that is deductible for tax purposes subsequent to being recognized in financial income. 4. Records the deferred tax consequences attributable to taxable temporary differences. 5. Differences between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years. 6. Records the deferred tax consequences attributable to deductible temporary differences and carryforwards. 7. The result from the recovery of an asset related to a revenue or gain that is taxable subsequent to being recognized in financial income. 8. The net change during the year in an entity's deferred tax liabilities and assets. 9. The amount of taxes paid or payable (or refundable) for the year as determined by applying the enacted tax law to the taxable income or excess of deductions over revenues for that year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts