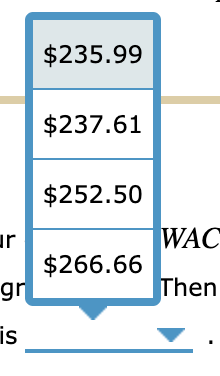

Question: options for blank #1: options for blank #2: options for blank #3: *PLEASE ANSWER ALL ELEMENTS OF QUESTION, PLEASE NO HANDWRITING. THANK YOU = Suppose

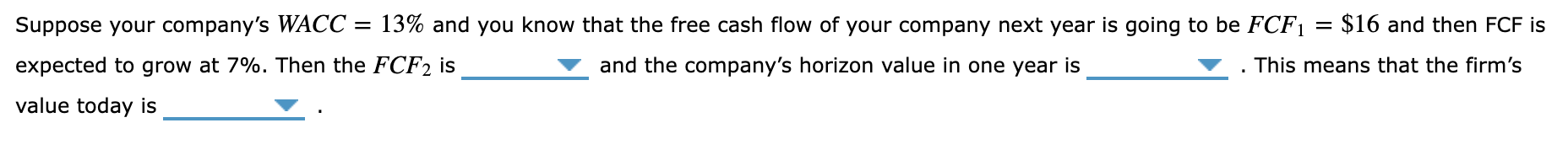

options for blank #1:

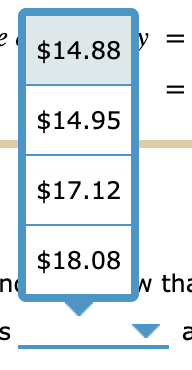

options for blank #2:

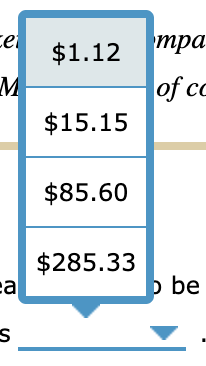

options for blank #3:

*PLEASE ANSWER ALL ELEMENTS OF QUESTION, PLEASE NO HANDWRITING. THANK YOU

= Suppose your company's WACC = 13% and you know that the free cash flow of your company next year is going to be FCF1 = $16 and then FCF is expected to grow at 7%. Then the FCF2 is and the company's horizon value in one year is This means that the firm's value today is V = $14.88 II 11 $14.95 $17.12 $18.08 no w tha S a zei $1.12 M of cc $15.15 $85.60 $285.33 b be a S $235.99 $237.61 $252.50 ur WAC $266.66 gr Then is

Step by Step Solution

There are 3 Steps involved in it

To solve this problem lets proceed step by step Step 1 Calculate FCF Given FCF1 16 Growth ... View full answer

Get step-by-step solutions from verified subject matter experts