Question: Options for general journal No Journal Entry Required Accounts Payable Accounts Receivable Accumulated Amortization Accumulated DepreciationBuildings Accumulated DepreciationEquipment Accumulated DepreciationVehicles Accumulated Other Comprehensive Income Additional

Options for general journal

- No Journal Entry Required

- Accounts Payable

- Accounts Receivable

- Accumulated Amortization

- Accumulated DepreciationBuildings

- Accumulated DepreciationEquipment

- Accumulated DepreciationVehicles

- Accumulated Other Comprehensive Income

- Additional Paid-In Capital, Common Stock

- Additional Paid-In Capital, Preferred Stock

- Additional Paid-In Capital, Treasury Stock

- Advertising Expense

- Allowance for Doubtful Accounts

- Amortization Expense

- Bad Debt Expense

- Bonds Payable

- Buildings

- Cash

- Cash Equivalents

- Cash Overage

- Cash Shortage

- Charitable Contributions Payable

- Common Stock

- Copyrights

- Cost of Goods Sold

- Deferred Revenue

- Delivery Expense

- Depreciation Expense

- Discount on Bonds Payable

- Dividends

- Dividends Payable

- Donation Revenue

- Equipment

- FICA Payable

- Franchise Rights

- Gain on Bond Retirement

- Gain on Disposal of PPE

- Goodwill

- Impairment Loss

- Income Tax Expense

- Income Tax Payable

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Receivable

- Interest Revenue

- Inventory

- Inventory - Estimated Returns

- Land

- Legal Expense

- Licensing Rights

- Logo and Trademarks

- Loss on Bond Retirement

- Loss on Disposal of PPE

- Natural Resource Assets

- Notes Payable (long-term)

- Notes Payable (short-term)

- Notes Receivable (long-term)

- Notes Receivable (short-term)

- Office Expenses

- Other Current Assets

- Other Noncurrent Assets

- Other Noncurrent Liabilities

- Other Operating Expenses

- Other Revenue

- Patents

- Payroll Tax Expense

- Petty Cash

- Preferred Stock

- Premium on Bonds Payable

- Prepaid Advertising

- Prepaid Insurance

- Prepaid Rent

- Refund Liability

- Rent Expense

- Rent Revenue

- Repairs and Maintenance Expense

- Restricted Cash (long-term)

- Restricted Cash (short-term)

- Retained Earnings

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Revenue

- Sales Tax Payable

- Service Revenue

- Short-term Investments

- Software

- Subscription Revenue

- Supplies

- Supplies Expense

- Travel Expense

- Treasury Stock

- Unemployment Tax Payable

- Utilities Expense

- Vehicles

- Withheld Income Taxes Payable

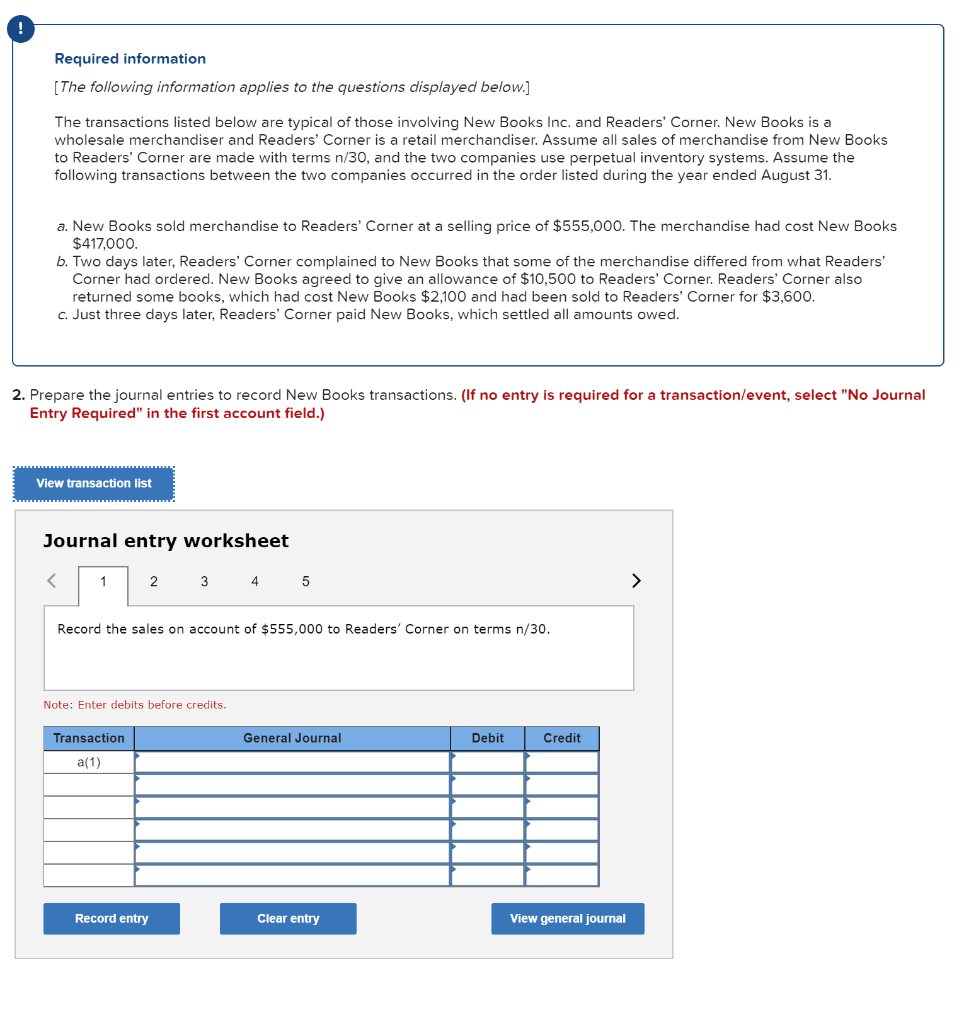

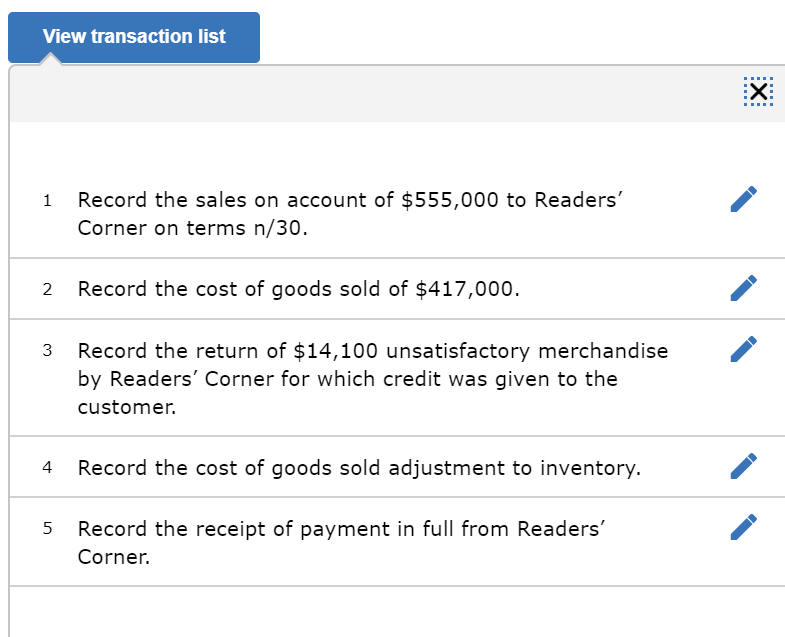

Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving New Books Inc. and Readers' Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31 a. New Books sold merchandise to Readers' Corner at a selling price of $555,000. The merchandise had cost New Books $417,000 b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers Corner had ordered. New Books agreed to give an allowance of $10,500 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $2,100 and had been sold to Readers' Corner for $3,600 c. Just three days later, Readers' Corner paid New Books, which settled all amounts owed 2. Prepare the journal entries to record New Books transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 4 Record the sales on account of $555,000 to Readers' Corner on terms n/30 Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal View transaction list Record the sales on account of $555,000 to Readers' Corner on terms n/30. 1 2 Record the cost of goods sold of $417,000 Record the return of $14,100 unsatisfactory merchandise by Readers' Corner for which credit was given to the customer. 3 4 Record the cost of goods sold adjustment to inventory. Record the receipt of payment in full from Readers Corner. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts