Question: or 2019, the standard deduction amount is $12,200 for Single, $18,350 for Head of Household and $24,400 for Married Filing Jointly. elf-employment Tax Rate for

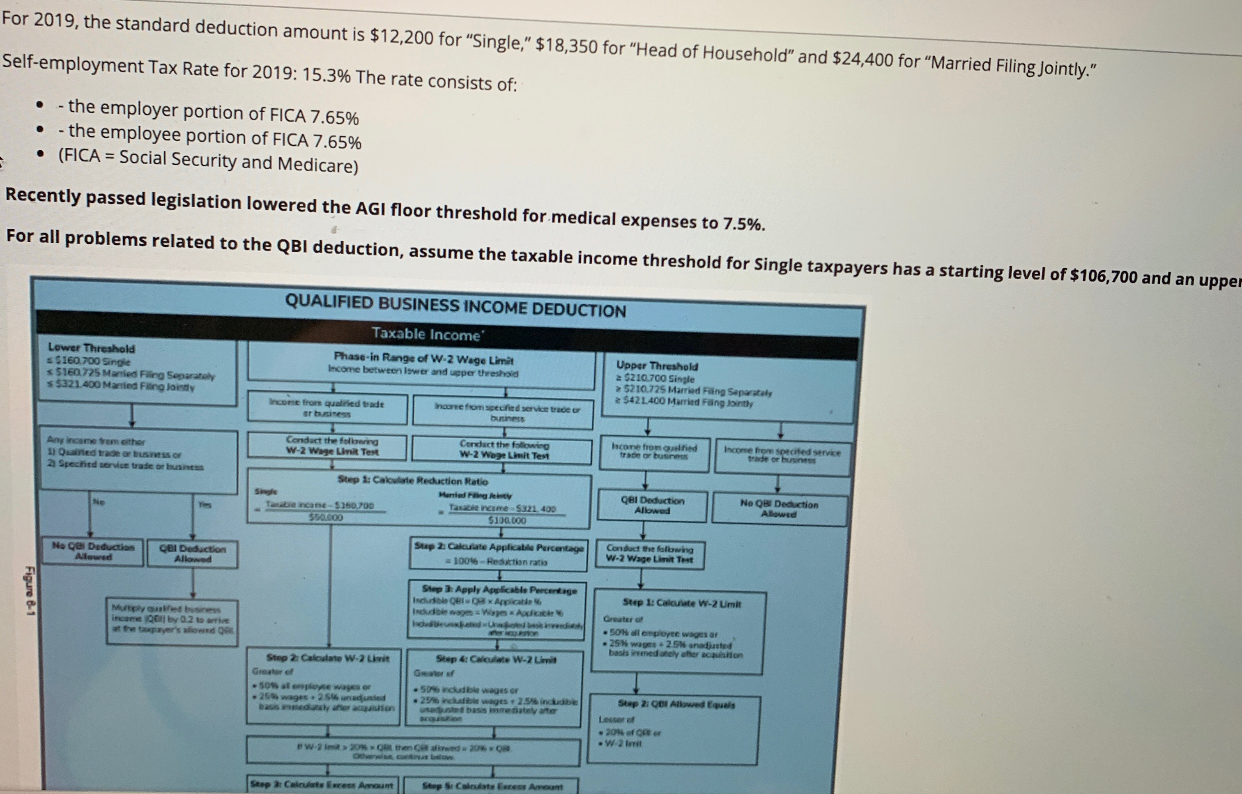

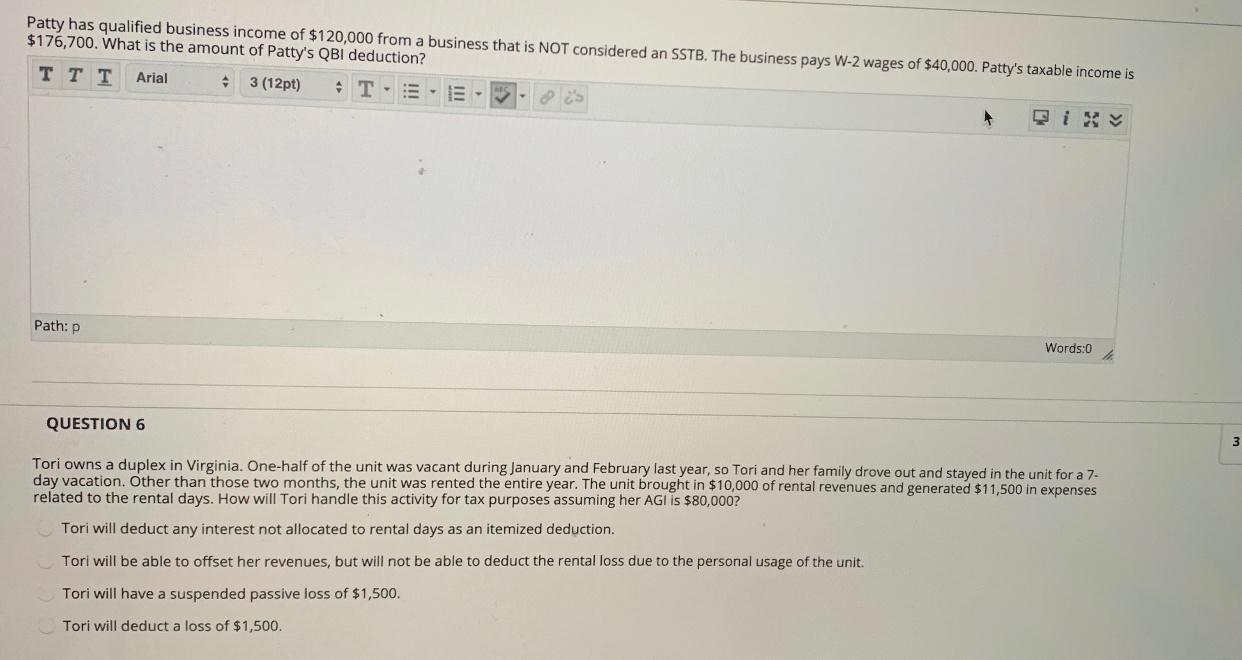

or 2019, the standard deduction amount is $12,200 for "Single," $18,350 for "Head of Household and $24,400 for Married Filing Jointly." elf-employment Tax Rate for 2019: 15.3% The rate consists of: . - the employer portion of FICA 7.65% - the employee portion of FICA 7.65% (FICA = Social Security and Medicare) Recently passed legislation lowered the AGI floor threshold for medical expenses to 7.5%. For all problems related to the QBI deduction, assume the taxable income threshold for Single taxpayers has a starting level of $106,700 and an uppel QUALIFIED BUSINESS INCOME DEDUCTION Lower Threshold S160 700 Single s 5160725 Manied Filing Separately s $321.400 Married Finland Taxable income Phase-in Range of W-2 Wage Limit Income between lower and upper threshold Upper Threshold $210.700 Single > 5210.725 Married Ring Separately 2542L400 Married Fangity Income from qualidade hoone from specified service trace Incontro grad Innerstede Conduct the following W-2 Wage Link Test Conduct the following W-2 Wege Limit Test Il Quedad or husessor 2 Spechied service trade Step 1: Calle Reduction Ratio Handled event-$250.700 Tarime 5321400 SET OO $100.000 Qel Deduction Allowed Ne On Dection Allowed T Contact the following W-2 Wage List Test Ne Qe Deduction Step 2. Calculate Applicatie Percentage -100-Restorati GOI Deduction Allowed Step Aeply Applicable Percentage Step 1: Calcate W-2 Unk Figure 8-1 50 proye wages or .25wages 25 najted Step 2: Calcate W-2 Step & C W -2 Gewer 50 dude wages or 1.25 wages.2.5 inci 2 wages.25% Step 2: Qol Allowed quals 20% of .W-2 Patty has qualified business income of $120,000 from a business that is NOT considered an SSTB. The business pays W-2 wages of $40,000. Patty's taxable income is $176,700. What is the amount of Patty's QBI deduction? T T T Arial 3 (12pt) T- - E . O's Path: P Words:0 QUESTION 6 Tori owns a duplex in Virginia. One-half of the unit was vacant during January and February last year, so Tori and her family drove out and stayed in the unit for a 7- day vacation. Other than those two months, the unit was rented the entire year. The unit brought in $10,000 of rental revenues and generated $11,500 in expenses related to the rental days. How will Tori handle this activity for tax purposes assuming her AGI is $80,000? Tori will deduct any interest not allocated to rental days as an itemized deduction. Tori will be able to offset her revenues, but will not be able to deduct the rental loss due to the personal usage of the unit. Tori will have a suspended passive loss of $1,500. Tori will deduct a loss of $1,500. or 2019, the standard deduction amount is $12,200 for "Single," $18,350 for "Head of Household and $24,400 for Married Filing Jointly." elf-employment Tax Rate for 2019: 15.3% The rate consists of: . - the employer portion of FICA 7.65% - the employee portion of FICA 7.65% (FICA = Social Security and Medicare) Recently passed legislation lowered the AGI floor threshold for medical expenses to 7.5%. For all problems related to the QBI deduction, assume the taxable income threshold for Single taxpayers has a starting level of $106,700 and an uppel QUALIFIED BUSINESS INCOME DEDUCTION Lower Threshold S160 700 Single s 5160725 Manied Filing Separately s $321.400 Married Finland Taxable income Phase-in Range of W-2 Wage Limit Income between lower and upper threshold Upper Threshold $210.700 Single > 5210.725 Married Ring Separately 2542L400 Married Fangity Income from qualidade hoone from specified service trace Incontro grad Innerstede Conduct the following W-2 Wage Link Test Conduct the following W-2 Wege Limit Test Il Quedad or husessor 2 Spechied service trade Step 1: Calle Reduction Ratio Handled event-$250.700 Tarime 5321400 SET OO $100.000 Qel Deduction Allowed Ne On Dection Allowed T Contact the following W-2 Wage List Test Ne Qe Deduction Step 2. Calculate Applicatie Percentage -100-Restorati GOI Deduction Allowed Step Aeply Applicable Percentage Step 1: Calcate W-2 Unk Figure 8-1 50 proye wages or .25wages 25 najted Step 2: Calcate W-2 Step & C W -2 Gewer 50 dude wages or 1.25 wages.2.5 inci 2 wages.25% Step 2: Qol Allowed quals 20% of .W-2 Patty has qualified business income of $120,000 from a business that is NOT considered an SSTB. The business pays W-2 wages of $40,000. Patty's taxable income is $176,700. What is the amount of Patty's QBI deduction? T T T Arial 3 (12pt) T- - E . O's Path: P Words:0 QUESTION 6 Tori owns a duplex in Virginia. One-half of the unit was vacant during January and February last year, so Tori and her family drove out and stayed in the unit for a 7- day vacation. Other than those two months, the unit was rented the entire year. The unit brought in $10,000 of rental revenues and generated $11,500 in expenses related to the rental days. How will Tori handle this activity for tax purposes assuming her AGI is $80,000? Tori will deduct any interest not allocated to rental days as an itemized deduction. Tori will be able to offset her revenues, but will not be able to deduct the rental loss due to the personal usage of the unit. Tori will have a suspended passive loss of $1,500. Tori will deduct a loss of $1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts