Question: or 2019, the standard deduction amount is $12,200 for Single, $18,350 for Head of Household and $24,400 for Married Filing Jointly. elf-employment Tax Rate for

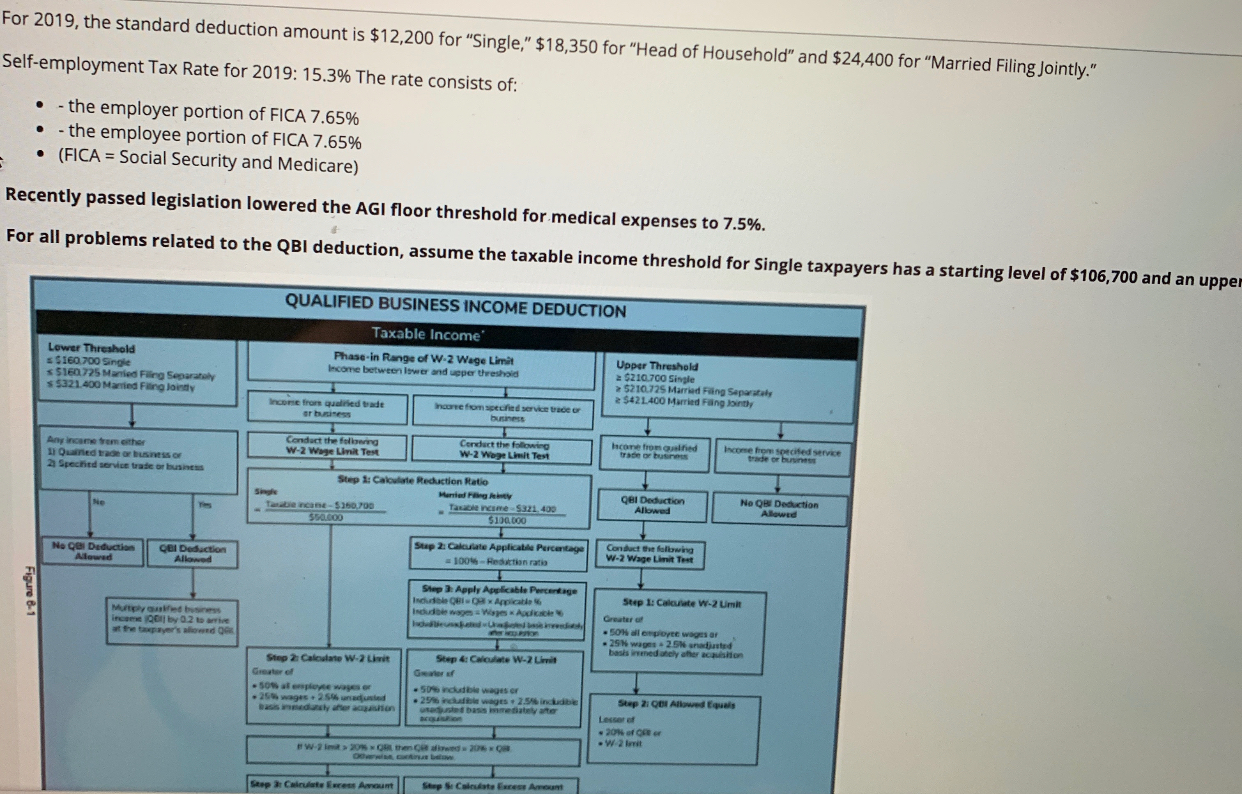

or 2019, the standard deduction amount is $12,200 for "Single," $18,350 for "Head of Household and $24,400 for Married Filing Jointly." elf-employment Tax Rate for 2019: 15.3% The rate consists of: . - the employer portion of FICA 7.65% - the employee portion of FICA 7.65% (FICA = Social Security and Medicare) Recently passed legislation lowered the AGI floor threshold for medical expenses to 7.5%. For all problems related to the QBI deduction, assume the taxable income threshold for Single taxpayers has a starting level of $106,700 and an uppel QUALIFIED BUSINESS INCOME DEDUCTION Lower Threshold S160 700 Single s 5160725 Manied Filing Separately s $321.400 Married Finland Taxable income Phase-in Range of W-2 Wage Limit Income between lower and upper threshold Upper Threshold $210.700 Single > 5210.725 Married Ring Separately 2542L400 Married Fangity Income from qualidade hoone from specified service trace Incontro grad Innerstede Conduct the following W-2 Wage Link Test Conduct the following W-2 Wege Limit Test Il Quedad or husessor 2 Spechied service trade Step 1: Calle Reduction Ratio Handled event-$250.700 Tarime 5321400 SET OO $100.000 Qel Deduction Allowed Ne On Dection Allowed T Contact the following W-2 Wage List Test Ne Qe Deduction Step 2. Calculate Applicatie Percentage -100-Restorati GOI Deduction Allowed Step Aeply Applicable Percentage Step 1: Calcate W-2 Unk Figure 8-1 50 proye wages or .25wages 25 najted Step 2: Calcate W-2 Step & C W -2 Gewer 50 dude wages or 1.25 wages.2.5 inci 2 wages.25% Step 2: Qol Allowed quals 20% of .W-2 Paul has qualified business income of $76,000 from a business that is NOT an SSTB. The business pays W-2 wages of $40,000. Paul's taxable income before the QBID is $56,000. What is the amount of Paul's QBI deduction? TT T Arial 3 (12pt) T E E . . O is Words:0 Path'n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts