Question: or Assignment 2, you will first create a schedule for the last 2 months of the draw period of a line of credit (LOC) loan

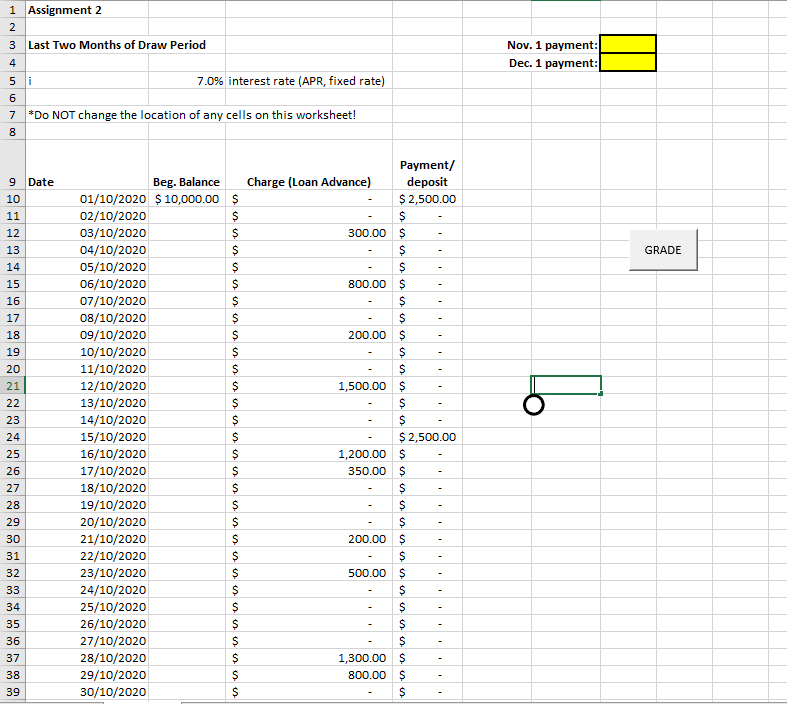

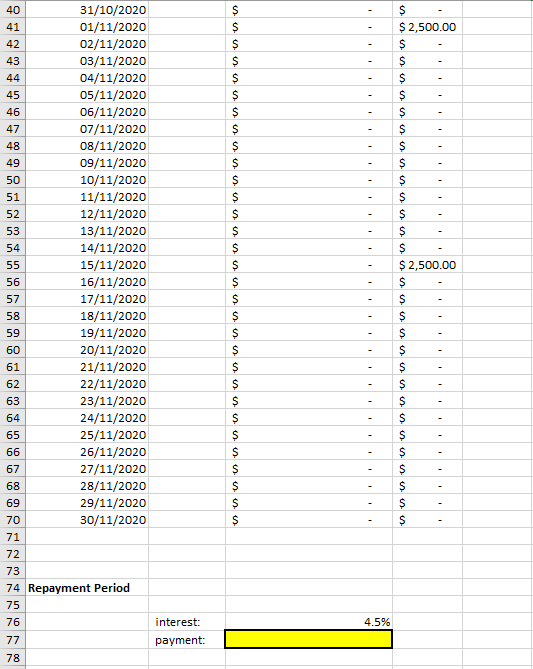

| or Assignment 2, you will first create a schedule for the last 2 months of the draw period of a line of credit (LOC) loan using the average daily balance method. The "Assignment 2.xlsx" file shows a beginning balance of $10,000 and charges (loan advances) throughout October. Payments (deposits) of $2500 are made on the 1st and 15th of each month and there are no new charges in the month of November. The "Payment/deposit" column represents payments that are in addition to the Nov. 1 payment and the Dec. 1 payment. You must make sure that the Nov. 1 payment and Dec. 1 payment show up in cells G3 and G4, respectively.

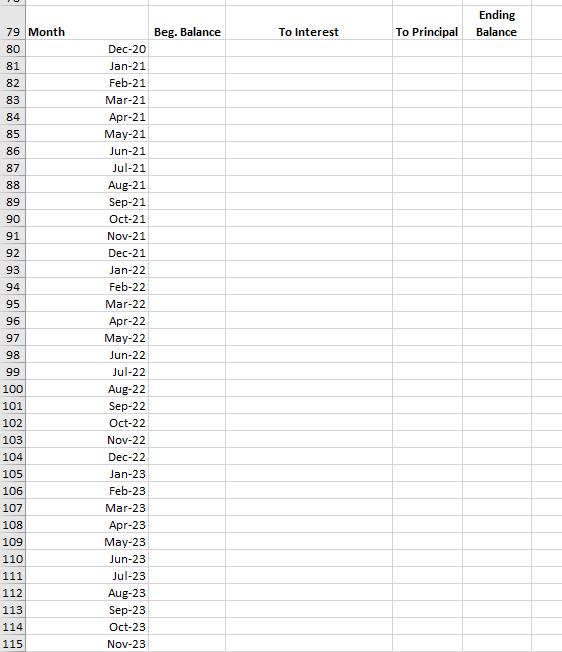

Then, you will create an amortization schedule for the repayment period, in which the remaining balance from the draw period is placed on an amortized 5-year loan (interest rate in cell C76 and compounded monthly). You need to make sure that you are calculating the monthly payment for the repayment period, which needs to show up in cell C77:

The grader file will alter things such as: beginning balance of draw period (cell B10), draw period and repayment period interest rates, amounts of expenses and payments during the draw period, and timing of expenses and payments during the draw period. It will look for the correct values in the "Ending Balance" column for various months of the amortized loan. So, be sure not to "hardwire" your formulas and make them such that they adapt to different numbers, etc.

|

1 Assignment 2 2 3 Last Two Months of Draw Period 4 5 i 7.0% interest rate (APR, fixed rate) 6 7 *Do NOT change the location of any cells on this worksheet! 8 Nov. 1 payment: Dec. 1 payment: Payment/ Charge (Loan Advance) deposit $ 2,500.00 $ 300.00 $ GRADE 9 Date 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Beg. Balance 01/10/2020 $ 10,000.00 $ 02/10/2020 $ 03/10/2020 $ 04/10/2020 $ 05/10/2020 $ 06/10/2020 $ 07/10/2020 $ 08/10/2020 $ 09/10/2020 10/10/2020 $ 11/10/2020 S 12/10/2020 $ 13/10/2020 $ 14/10/2020 S 15/10/2020 16/10/2020 $ 17/10/2020 $ 18/10/2020 $ 19/10/2020 $ 20/10/2020 S 21/10/2020 22/10/2020 23/10/2020 $ 24/10/2020 $ 25/10/2020 $ 26/10/2020 $ 27/10/2020 $ 28/10/2020 $ 29/10/2020 $ 30/10/2020 $ $ 800.00 $ $ $ 200.00 $ $ $ 1,500.00 $ $ $ $ 2,500.00 1,200.00 $ 350.00 $ $ $ $ 200.00 $ . . . . . . . . . . . . . . . 500.00 $ . . . . . . . $ $ 1,300.00 $ 800.00 $ $ $ $ 2,500.00 $ $ $ $ 43 S $ $ $ $ $ 40 31/10/2020 41 01/11/2020 42 02/11/2020 03/11/2020 44 04/11/2020 45 05/11/2020 46 06/11/2020 47 07/11/2020 48 08/11/2020 49 09/11/2020 50 10/11/2020 51 11/11/2020 52 12/11/2020 53 13/11/2020 54 14/11/2020 55 15/11/2020 56 16/11/2020 57 17/11/2020 58 18/11/2020 59 19/11/2020 60 20/11/2020 61 21/11/2020 62 22/11/2020 63 23/11/2020 64 24/11/2020 65 25/11/2020 66 26/11/2020 67 27/11/2020 68 28/11/2020 69 29/11/2020 70 30/11/2020 71 72 73 74 Repayment Period 75 76 77 $ $ $ $ $ $ $ $ $ 2,500.00 $ $ $ $ . . . . . . . . $ $ $ $ $ $ $ $ $ $ $ $ $ interest: 4.5% payment: 78 Ending Balance Beg. Balance To Interest To Principal 79 Month 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts