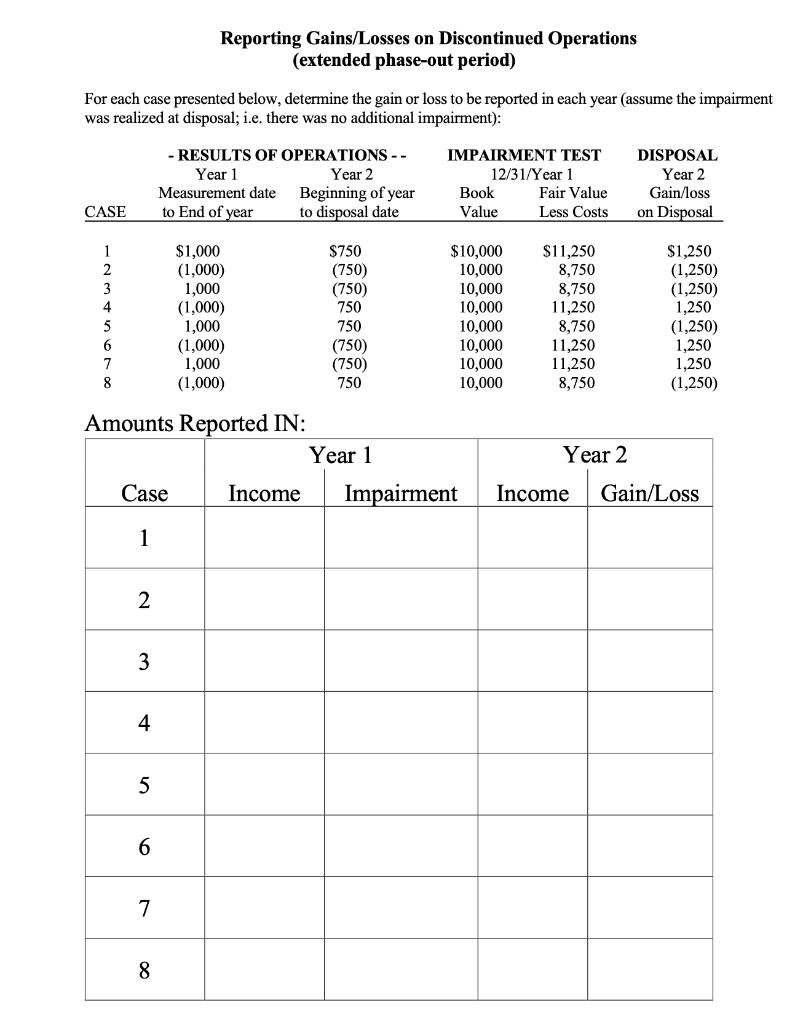

Question: Reporting Gains/Losses on Discontinued Operations (extended phase-out period) For each case presented below, determine the gain or loss to be reported in each year

Reporting Gains/Losses on Discontinued Operations (extended phase-out period) For each case presented below, determine the gain or loss to be reported in each year (assume the impairment was realized at disposal; i.e. there was no additional impairment): - RESULTS OF OPERATIONS - - IMPAIRMENT TEST Year 2 12/31/Year 1 Year 1 Measurement date to End of year DISPOSAL Year 2 Gain/loss on Disposal Book Fair Value Beginning of year to disposal date CASE Value Less Costs 1 $1,000 $750 $10,000 $11,250 $1,250 2 (1,000) (750) 10,000 8,750 (1,250) 3 1,000 (750) 10,000 8,750 (1,250) 4 (1,000) 750 10,000 11,250 1,250 5 1,000 750 10,000 8,750 (1,250) 6 (1,000) (750) 10,000 11,250 1,250 7 1,000 (750) 10,000 11,250 1,250 8 (1,000) 750 10,000 8,750 (1,250) Amounts Reported IN: Year 1 Year 2 Case Income Income Gain/Loss 1 2 3 4 5 6 7 8 Impairment

Step by Step Solution

There are 3 Steps involved in it

Reporting GainsLosses on Discontued Operations Case 1 11250 10000 1250 Gain Year 1 Income loss from operations 1000 Gains loss from disposal Gains fro... View full answer

Get step-by-step solutions from verified subject matter experts