Question: ord Insert Autoum Recently Financial logical test Date & Lookup Matha the informu Catate Now trace Dependents for Checking More Function Used Time Reference The

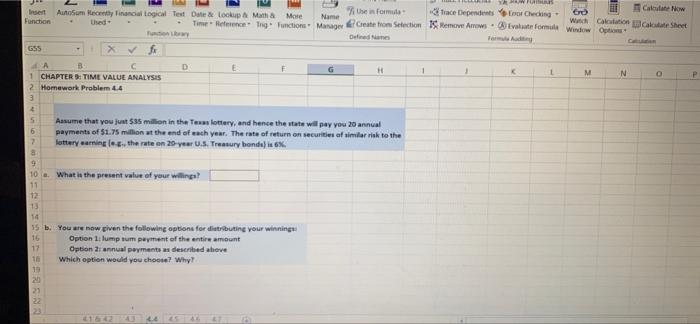

ord Insert Autoum Recently Financial logical test Date & Lookup Matha the informu Catate Now trace Dependents for Checking More Function Used Time Reference The Functions Manager Create on Selection Remco Awes var formule Window or Winch Sheet Defined as GSS X f A B C D G H 1 M N 0 1 CHAPTER : TIME VALUE ANALYSIS 2 Homework Problem 4.4 3 - Assume that you just $35 million in the Tewas lottery, and hence the state will pay you 20 annual 6 payments of $1.75 million at the end of each year. The rate of return on securities of similar risk to the 2 lottery caring the rate on 20 year U.S. Treasury bondas X 8 19 10 . What is the present value of your willing! 11 12 13 14 St. You are now given the following options for distributing your winning 16 Option 1. lump sum payment of the entire amount 17 Options annual payments described above Which option would you choose? Why? 19 20 21 22 23 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts