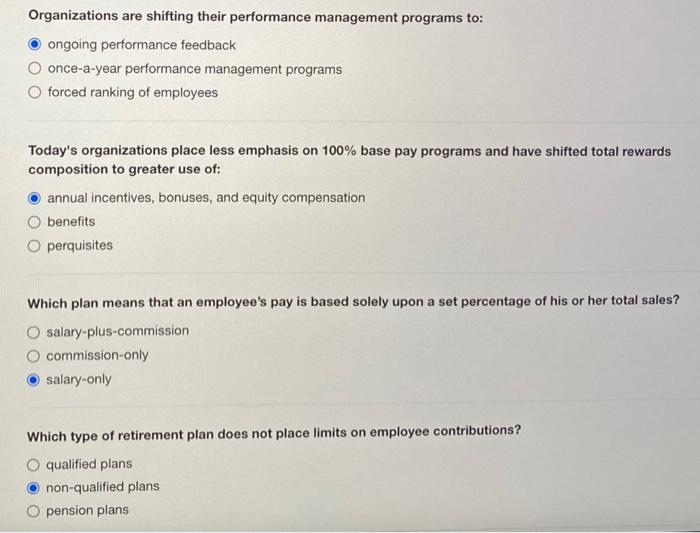

Question: Organizations are shifting their performance management programs to: ongoing performance feedback once-a-year performance management programs forced ranking of employees Today's organizations place less emphasis on

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock