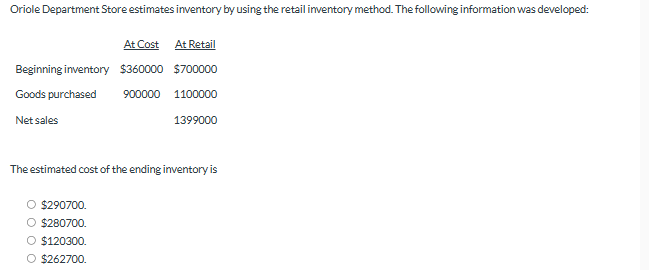

Question: Oriole Department Store estimates inventory by using the retail inventory method. The following information was developed: At Cost At Retail Beginning inventory $360000 $700000

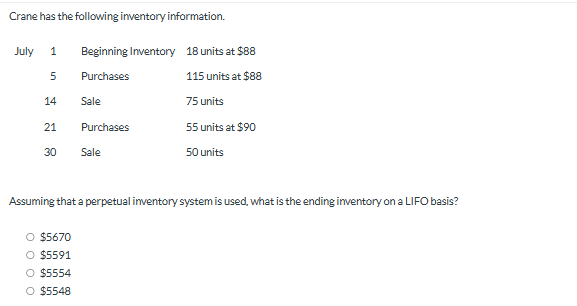

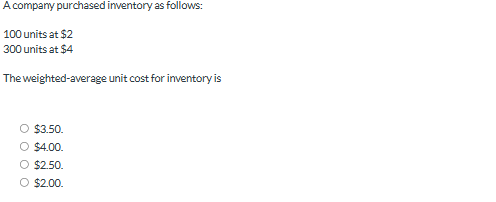

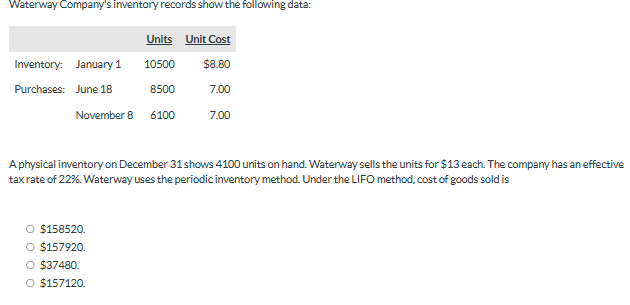

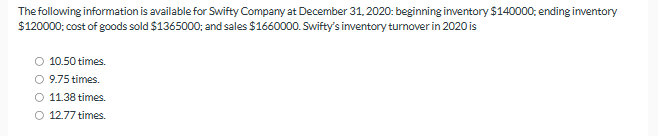

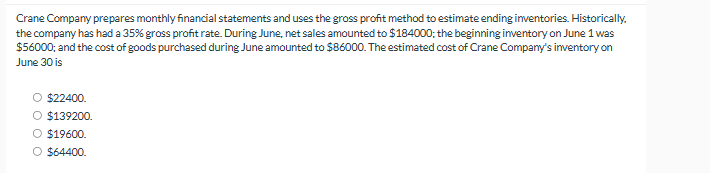

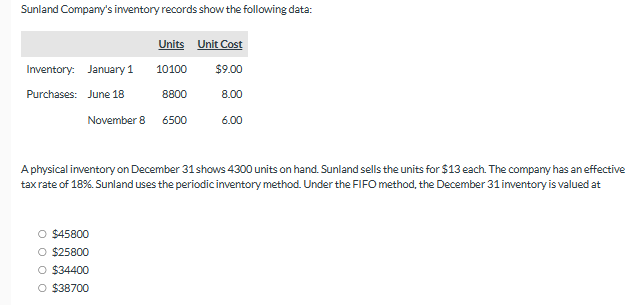

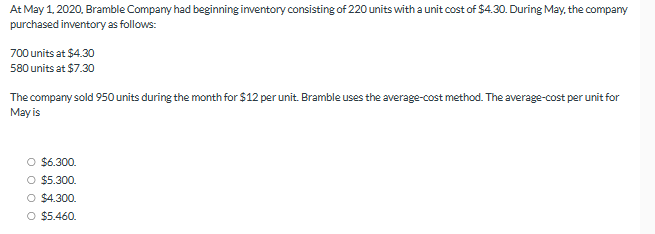

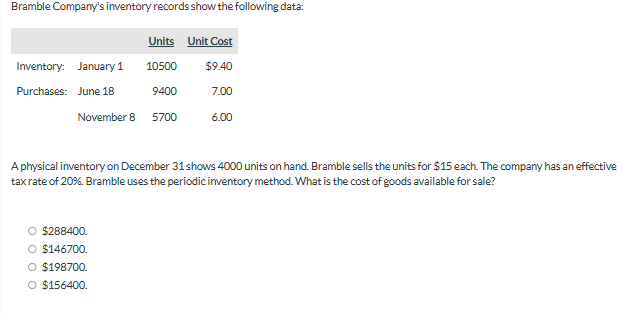

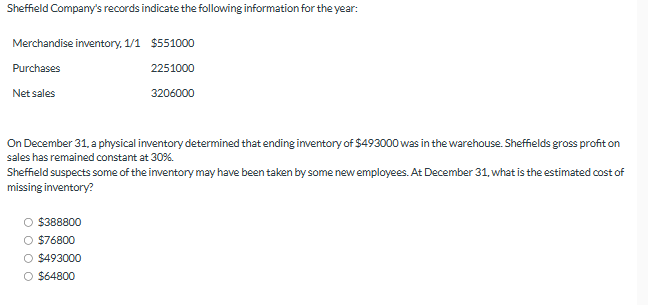

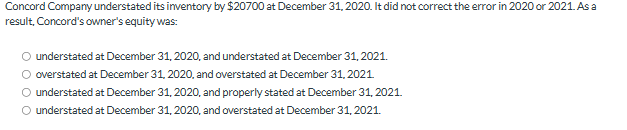

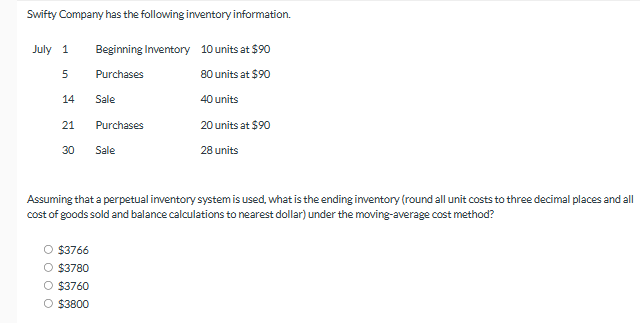

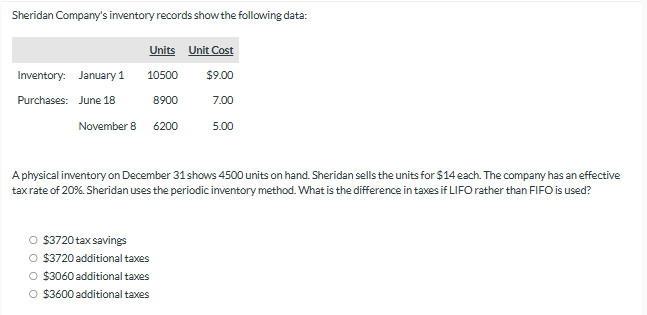

Oriole Department Store estimates inventory by using the retail inventory method. The following information was developed: At Cost At Retail Beginning inventory $360000 $700000 Goods purchased Net sales 900000 1100000 1399000 The estimated cost of the ending inventory is $290700. $280700. $120300. $262700. Crane has the following inventory information. July 1 Beginning Inventory 18 units at $88 5 Purchases 115 units at $88 14 Sale 75 units 21 Purchases 55 units at $90 30 Sale 50 units Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis? $5670 $5591 $5554 $5548 A company purchased inventory as follows: 100 units at $2 300 units at $4 The weighted-average unit cost for inventory is $3.50. $4.00. O $2.50. $2.00. Waterway Company's inventory records show the following data: Units Unit Cost Inventory: January 1 10500 $8.80 Purchases: June 18 8500 7.00 November 8 6100 7.00 A physical inventory on December 31 shows 4100 units on hand. Waterway sells the units for $13 each. The company has an effective tax rate of 22%. Waterway uses the periodic inventory method. Under the LIFO method, cost of goods sold is O $158520. $157920. $37480. $157120. The following information is available for Swifty Company at December 31, 2020: beginning inventory $140000; ending inventory $120000; cost of goods sold $1365000; and sales $1660000. Swifty's inventory turnover in 2020 is 10.50 times. 9.75 times. O 11.38 times. O 12.77 times. Crane Company prepares monthly financial statements and uses the gross profit method to estimate ending inventories. Historically. the company has had a 35% gross profit rate. During June, net sales amounted to $184000; the beginning inventory on June 1 was $56000; and the cost of goods purchased during June amounted to $86000. The estimated cost of Crane Company's inventory on June 30 is $22400. $139200. $19600. $64400. Sunland Company's inventory records show the following data: Units Unit Cost Inventory: January 1 10100 $9.00 Purchases: June 18 8800 8.00 November 8 6500 6.00 A physical inventory on December 31 shows 4300 units on hand. Sunland sells the units for $13 each. The company has an effective tax rate of 18%. Sunland uses the periodic inventory method. Under the FIFO method, the December 31 inventory is valued at $45800 $25800 $34400 $38700 At May 1, 2020, Bramble Company had beginning inventory consisting of 220 units with a unit cost of $4.30. During May, the company purchased inventory as follows: 700 units at $4.30 580 units at $7.30 The company sold 950 units during the month for $12 per unit. Bramble uses the average-cost method. The average-cost per unit for May is O $6.300. $5.300. $4.300. $5.460. Bramble Company's inventory records show the following data: Units Unit Cost Inventory: January 1 10500 $9.40 Purchases: June 18 9400 7.00 November 8 5700 6.00 A physical inventory on December 31 shows 4000 units on hand. Bramble sells the units for $15 each. The company has an effective tax rate of 20%. Bramble uses the periodic inventory method. What is the cost of goods available for sale? $288400. $146700. $198700. $156400. Sheffield Company's records indicate the following information for the year: Merchandise inventory, 1/1 $551000 Purchases Net sales 2251000 3206000 On December 31, a physical inventory determined that ending inventory of $493000 was in the warehouse. Sheffields gross profit on sales has remained constant at 30%. Sheffield suspects some of the inventory may have been taken by some new employees. At December 31, what is the estimated cost of missing inventory? $388800 $76800 $493000 $64800 Concord Company understated its inventory by $20700 at December 31, 2020. It did not correct the error in 2020 or 2021. As a result, Concord's owner's equity was: understated at December 31, 2020, and understated at December 31, 2021. overstated at December 31, 2020, and overstated at December 31, 2021 understated at December 31, 2020, and properly stated at December 31, 2021. O understated at December 31, 2020, and overstated at December 31, 2021. Swifty Company has the following inventory information. July 1 Beginning Inventory 10 units at $90 5 Purchases 80 units at $90 14 Sale 40 units 21 Purchases 20 units at $90 30 Sale 28 units Assuming that a perpetual inventory system is used, what is the ending inventory (round all unit costs to three decimal places and all cost of goods sold and balance calculations to nearest dollar) under the moving-average cost method? $3766 $3780 $3760 $3800 Sheridan Company's inventory records show the following data: Units Unit Cost Inventory: January 1 10500 $9.00 Purchases: June 18 8900 7.00 November 8 6200 5.00 A physical inventory on December 31 shows 4500 units on hand. Sheridan sells the units for $14 each. The company has an effective tax rate of 20%. Sheridan uses the periodic inventory method. What is the difference in taxes if LIFO rather than FIFO is used? $3720 tax savings $3720 additional taxes $3060 additional taxes $3600 additional taxes

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Here are the stepbystep calculations for the inventory questions 1 Oriole Department Store estimated inventory ... View full answer

Get step-by-step solutions from verified subject matter experts