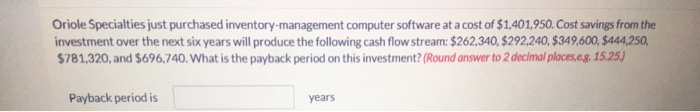

Question: Oriole Specialties just purchased inventory-management computer software at a cost of $1,401,950. Cost savings from the investment over the next six years will produce the

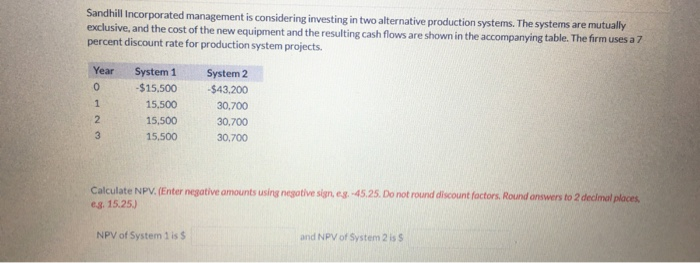

Oriole Specialties just purchased inventory-management computer software at a cost of $1,401,950. Cost savings from the investment over the next six years will produce the following cash flow stream: $262,340, $292,240, $349,600, $444,250, $781,320, and $696,740. What is the payback period on this investment? (Round answer to 2 decimal places,eg. 15.25) Payback period is years Sandhill Incorporated management is considering investing in two alternative production systems. The systems are mutually exclusive, and the cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses a 7 percent discount rate for production system projects. Year 0 1 2 3 System 1 -$15,500 15.500 15,500 15,500 System 2 -$43,200 30.700 30,700 30,700 Calculate NPV. (Enter negative amounts using negative sign. 3-45.25. Do not round discount factors. Round answers to 2 decimal places es. 15.250 NPV of System 1 is $ and NPV of System 2 is s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts