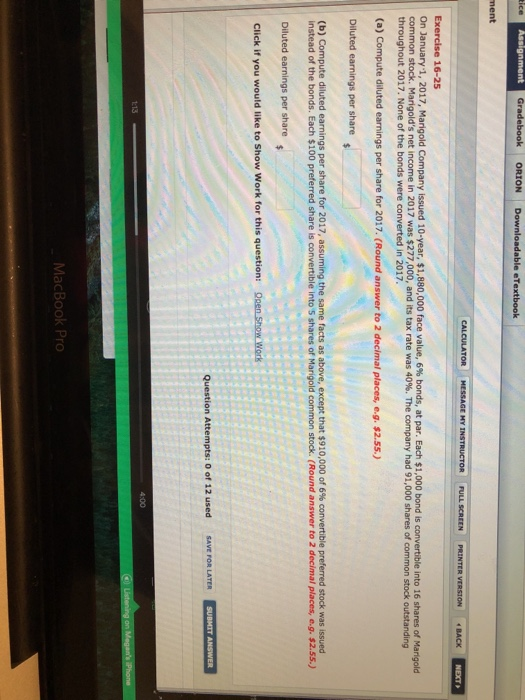

Question: ORION ruLL SCREEN PRNTER VERSION -BACK On January, 2017, Mangold Company issued io-year, $1.880,000 face value, 6% bonds, at par. Each $1,000 bond is convertible

ORION ruLL SCREEN PRNTER VERSION -BACK On January, 2017, Mangold Company issued io-year, $1.880,000 face value, 6% bonds, at par. Each $1,000 bond is convertible into 16 shares of Ma common stock. Marigold's net income in 2017 was $277,000, and its tax rate was 40%. The company had 91,000 shares of common stock outstanding throughout 2017. None of the bonds were converted in 2017 (a) Compute diluted earnings per share for 2017. (Round answer to 2 decimal places, e.g. $2.55.) Diluted earnings per share b) Compute diluted earnings per share for 2017, assuming the same facts as above, except that $910,000 of 6% convertible preferred stock was issued instead of the bonds. Each $100 preferred share is convertible into 5 shares of Marigold common stock. (Round answer to 2 decimal places, e.g. $2.55.) Diluted earnings per share Click if you would like to Show Work for this question: Open Show Work 4:00 1:13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts