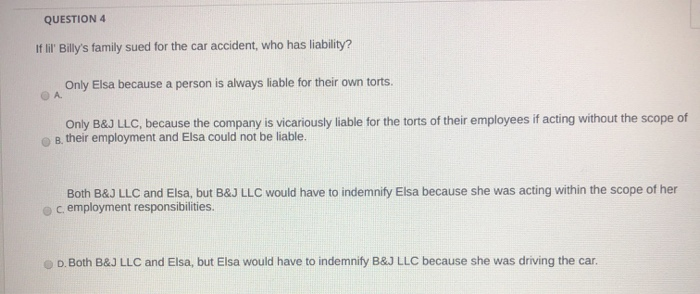

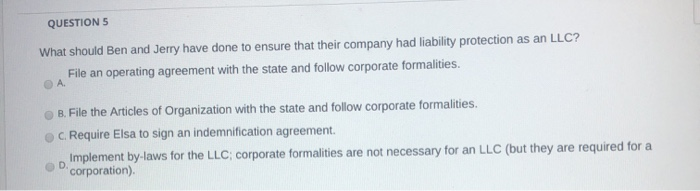

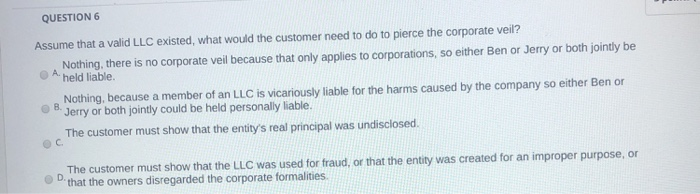

Question: ormation scription Please read the hypothetical and then answer the questions below. All questions are multiple choice. Participating in this assignment is optional. You may

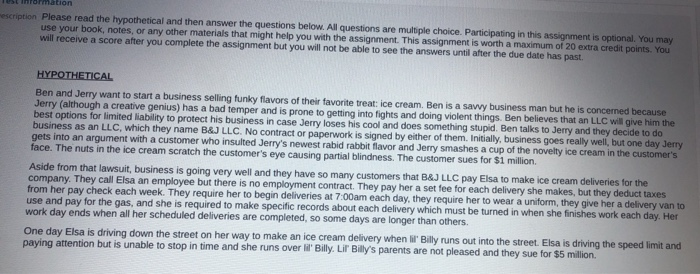

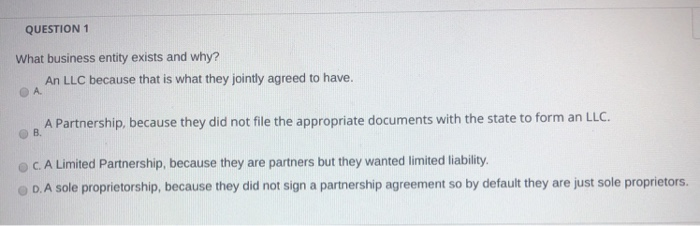

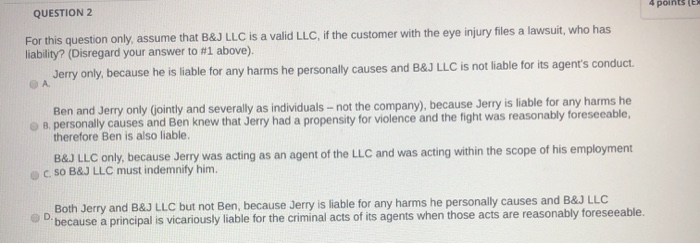

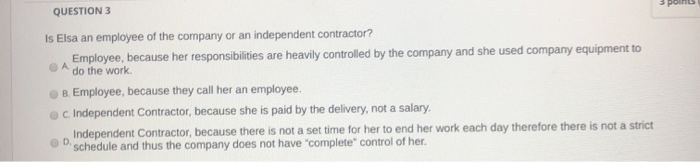

ormation scription Please read the hypothetical and then answer the questions below. All questions are multiple choice. Participating in this assignment is optional. You may use your book, notes, or any other materials that might help you with the assignment. This assignment is worth a maximum of 20 extra credit points. You will receive a score after you complete the assignment but you will not be able to see the answers until after the due date has past HYPOTHETICAL Ben and Jerry want to start a business selling funky flavors of their favorite treat: ice cream. Ben is a sawy business man but he is concerned because Jerry (although a creative genius) has a bad temper and is prone to getting into fights and doing violent things. Ben believes that an LLC will give him the best options for limited liability to protect his business in case Jerry loses his cool and does something stupid. Ben talks to Jerry and they decide to do business as an LLC, which they name B&J LLC. No contract or paperwork is signed by either of them. Initially, business goes really well, but one day Jerry gets into an argument with a customer who insulted Jerry's newest rabid rabbit flavor and Jerry smashes a cup of the novelty ice cream in the customer's face. The nuts in the ice cream scratch the customer's eye causing partial blindness. The customer sues for $1 million Aside from that lawsuit, business is going very well and they have so many customers that B&J LLC pay Elsa to make ice cream deliveries for the company. They call Elsa an employee but there is no employment contract. They pay her a set fee for each delivery she makes, but they deduct taxes from her pay check each week. They require her to begin deliveries at 7:00am each day, they require her to wear a uniform, they give her a delivery van to use and pay for the gas, and she is required to make specific records about each delivery which must be turned in when she finishes work each day. Her work day ends when all her scheduled deliveries are completed, so some days are longer than others One day Elsa is driving down the street on her way to make an ice cream delivery when lil' Billy runs out into the street. Elsa is driving the speed limit and paying attention but is unable to stop in time and she runs over lil' Billy. Lil Billy's parents are not pleased and they sue for $5 million QUESTION 1 What business entity exists and why? An LLC because that is what they jointly agreed to have. OA A Partnership, because they did not file the appropriate documents with the state to form an LLC. B CA Limited Partnership, because they are partners but they wanted limited liability D. A sole proprietorship, because they did not sign a partnership agreement so by default they are just sole proprietors. QUESTION 2 points For this question only, assume that B&J LLC is a valid LLC, if the customer with the eye injury files a lawsuit, who has liability? (Disregard your answer to #1 above). Jerry only, because he is liable for any harms he personally causes and B&J LLC is not liable for its agent's conduct. Ben and Jerry only (jointly and severally as individuals -not the company), because Jerry is liable for any harms he B. personally causes and Ben knew that Jerry had a propensity for violence and the fight was reasonably foreseeable, therefore Ben is also liable. B&J LLC only, because Jerry was acting as an agent of the LLC and was acting within the scope of his employment C. SO B&J LLC must indemnify him. Both Jerry and B&J LLC but not Ben, because Jerry is liable for any harms he personally causes and B&J LLC because a principal is vicariously liable for the criminal acts of its agents when those acts are reasonably foreseeable. 3 points QUESTION 3 Is Elsa an employee of the company or an independent contractor? Employee, because her responsibilities are heavily controlled by the company and she used company equipment to A do the work. B. Employee, because they call her an employee. c Independent Contractor, because she is paid by the delivery, not a salary. Independent Contractor, because there is not a set time for her to end her work each day therefore there is not a strict "schedule and thus the company does not have complete control of her. QUESTION 4 If lil'Billy's family sued for the car accident, who has liability? Only Elsa because a person is always liable for their own torts. Only B&J LLC, because the company is vicariously liable for the torts of their employees if acting without the scope of B. their employment and Elsa could not be liable. Both B&J LLC and Elsa, but B&J LLC would have to indemnify Elsa because she was acting within the scope of her c employment responsibilities. D. Both B&J LLC and Elsa, but Elsa would have to indemnify B&J LLC because she was driving the car. QUESTIONS What should Ben and Jerry have done to ensure that their company had liability protection as an LLC? File an operating agreement with the state and follow corporate formalities. OA B. File the Articles of Organization with the state and follow corporate formalities. c. Require Elsa to sign an indemnification agreement. D. Implement by-laws for the LLC: corporate formalities are not necessary for an LLC (but they are required for a corporation) QUESTION 6 Assume that a valid LLC existed, what would the customer need to do to pierce the corporate veil? Nothing, there is no corporate veil because that only applies to corporations, so either Ben or Jerry or both jointly be Aheld liable. Nothing, because a member of an LLC is vicariously liable for the harms caused by the company so either Ben or Jerry or both jointly could be held personally liable. The customer must show that the entity's real principal was undisclosed. oc The customer must show that the LLC was used for fraud, or that the entity was created for an improper purpose, or that the owners disregarded the corporate formalities