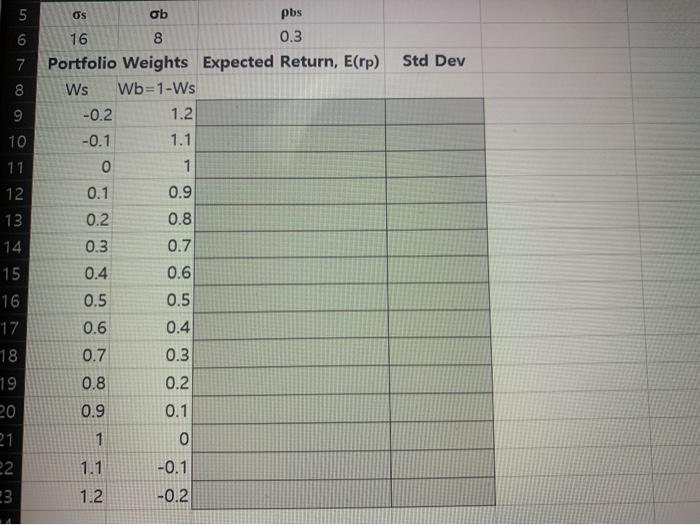

Question: Os 5 6 7 Std Dev 8 9 10 11 12 13 14 ob pbs 16 8 0.3 Portfolio Weights Expected Return, E(rp) Ws Wb=1-Ws

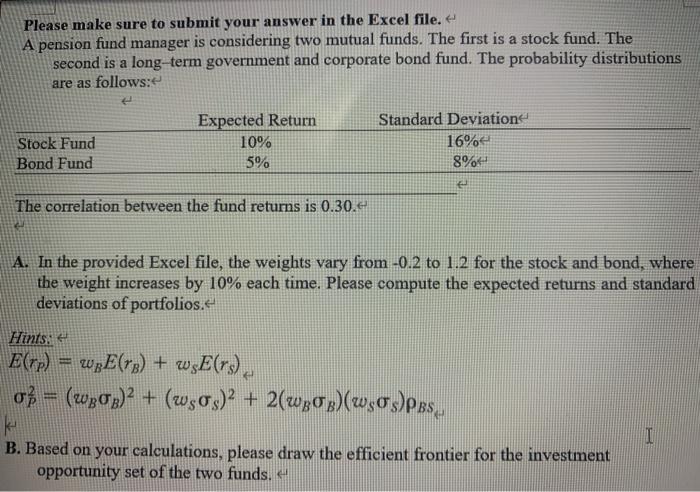

Os 5 6 7 Std Dev 8 9 10 11 12 13 14 ob pbs 16 8 0.3 Portfolio Weights Expected Return, E(rp) Ws Wb=1-Ws -0.2 1.2 -0.1 1.1 0 1 0.1 0.9 0.2 0.8 0.3 0.7 0.4 0.6 0.5 0.5 0.6 0.4 0.7 0.3 0.8 0.2 0.9 0.1 1 0 1.1 -0.1 1.2 -0.2 15 16 17 18 19 20 21 22 23 Please make sure to submit your answer in the Excel file. A pension fund manager is considering two mutual funds. The first is a stock fund. The second is a long-term government and corporate bond fund. The probability distributions are as follows: Stock Fund Bond Fund Expected Return 10% 5% Standard Deviation 16%e 8% The correlation between the fund returns is 0.30.4 A. In the provided Excel file, the weights vary from -0.2 to 1.2 for the stock and bond, where the weight increases by 10% each time. Please compute the expected returns and standard deviations of portfolios. Hints: E(rp) = wpE(rp) + wE(r), o} = (w20)2 + (w50s)2 + 2(wpop)(w50s)pes, pe B. Based on your calculations, please draw the efficient frontier for the investment opportunity set of the two funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts