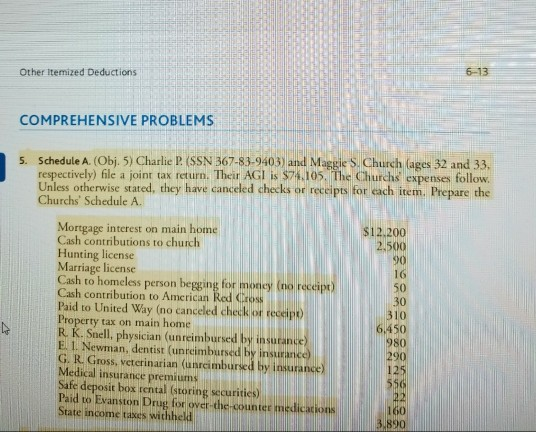

Question: Other itemized Deductions COMPREHENSIVE PROBLEMS 5. Schedule A. (Obj. 5) Charlie P. (SSN 367-83-9403) and Maggie S. Church ages 32 and 33. respectively) file a

Other itemized Deductions COMPREHENSIVE PROBLEMS 5. Schedule A. (Obj. 5) Charlie P. (SSN 367-83-9403) and Maggie S. Church ages 32 and 33. respectively) file a joint tax return. Their AGI is $74.105. The Churchs expenses follow. Unless otherwise stated, they have canceled checks or receipts for each item. Prepare the Churchs' Schedule A. 200 Mortgage interest on main home Cash contributions to church Hunting license Marriage license Cash to homeless person begging for money (no receipt) Cash contribution to American Red Cross Paid to United Way (no canceled check or receipo Property tax on main home R.K. Snell, physician (unreimbursed by insurance E. 1. Newman, dentist (unreimbursed by insun G.R. Gross, veterinarian (unreimbursed by insur Medical insurance premiums Safe deposit box rental (storing securities) Paid to Evanston Drug for over-the-counter medica State income taxes withheld 4 3.890

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts