Question: OUESTION 5 : Decision Analysis - Posterior / Revised Probability The NBS television network has to decide whether to air a show or not air

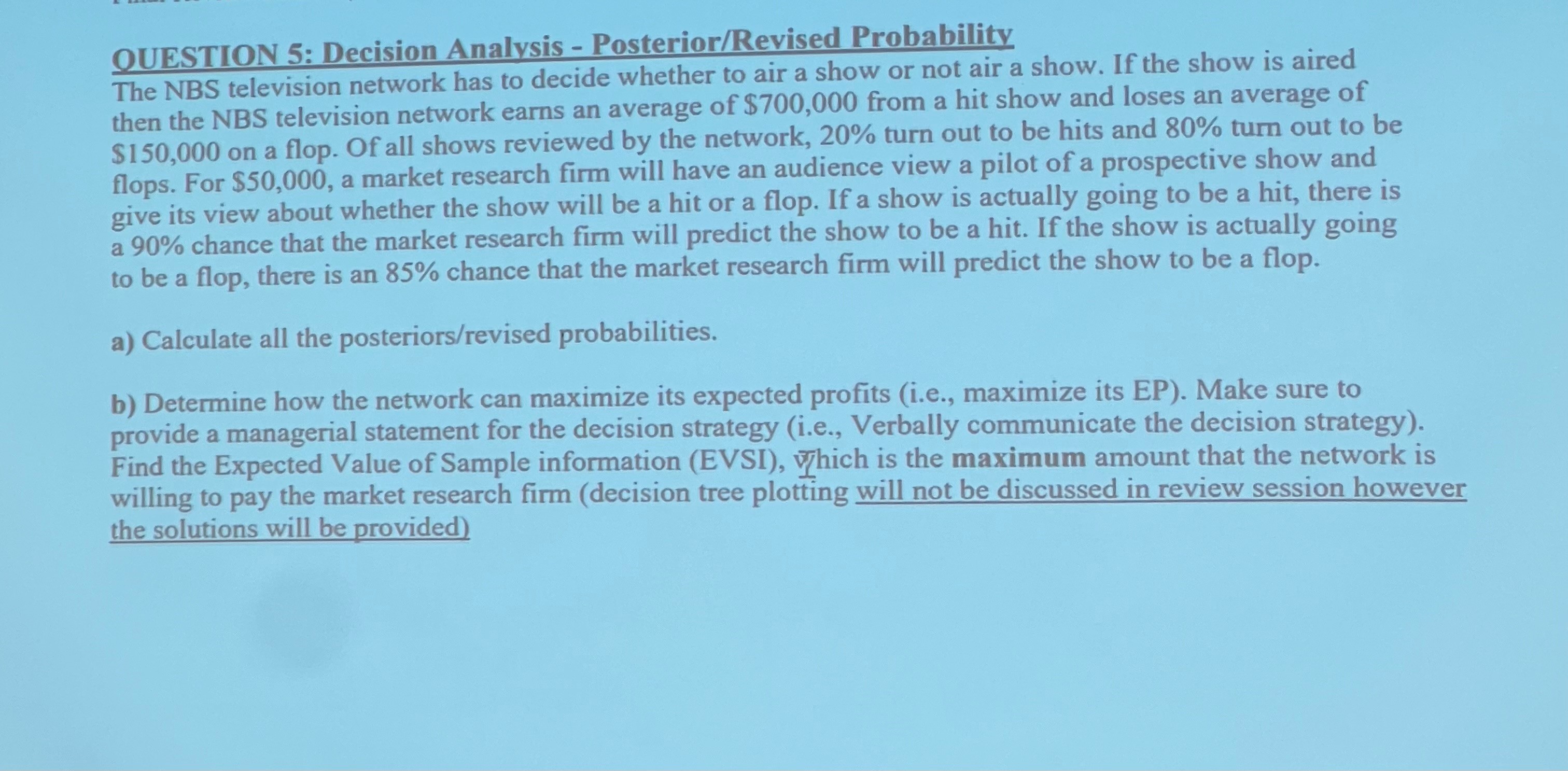

OUESTION : Decision Analysis PosteriorRevised Probability

The NBS television network has to decide whether to air a show or not air a show. If the show is aired

then the NBS television network earns an average of $ from a hit show and loses an average of

$ on a flop. Of all shows reviewed by the network, turn out to be hits and turn out to be

flops. For $ a market research firm will have an audience view a pilot of a prospective show and

give its view about whether the show will be a hit or a flop. If a show is actually going to be a hit, there is

a chance that the market research firm will predict the show to be a hit. If the show is actually going

to be a flop, there is an chance that the market research firm will predict the show to be a flop.

a Calculate all the posteriorsrevised probabilities.

b Determine how the network can maximize its expected profits ie maximize its EP Make sure to

provide a managerial statement for the decision strategy ie Verbally communicate the decision strategy

Find the Expected Value of Sample information EVSI which is the maximum amount that the network is

willing to pay the market research firm decision tree plotting will not be discussed in review session however

the solutions will be provided

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock