Question: our long term debt represents the remaining balance on a 30 year loan taken out in 1994 at 13% with options to refinance every 10

our long term debt represents the remaining balance on a 30 year loan taken out in 1994 at 13% with options to refinance every 10 years. If we refinance for the remaining 10 years at 7% how much interests expense will we save over the remainder of the loan? problem solved, but what was the original balance or principle in1994?

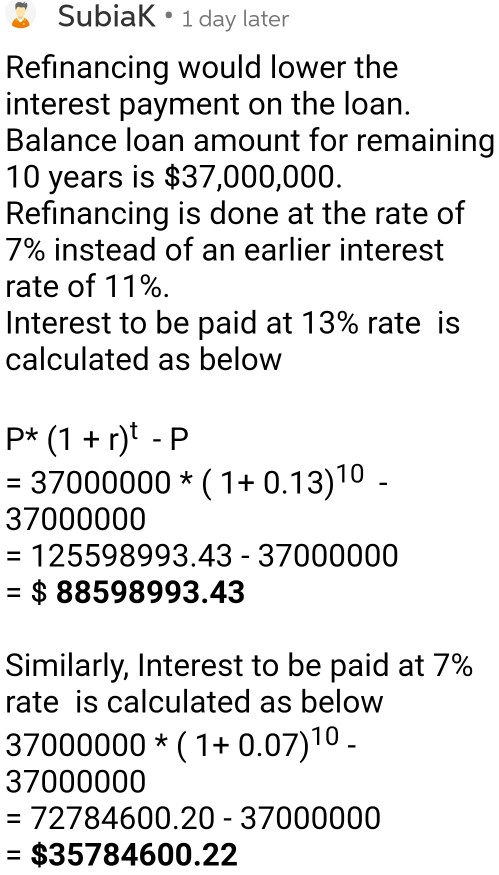

SubiaK . 1 day later Refinancing would lower the interest payment on the loan. Balance loan amount for remaining 10 years is $37,000,000 Refinancing is done at the rate of 7% instead of an earlier interest rate of 1 1 %. Interest to be paid at 13% rate is calculated as below P* (1 r) - P 10. 37000000*(1+ 0.13) 37000000 - 125598993.43 - 37000000 $88598993.43 Similarly, Interest to be paid at 7% rate is calculated as belovw 37000000*(1+0.07) 37000000 72784600.20 37000000 $35784600.22 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts