Question: ouTube Maps hapter 12 Homework i 2 ints eBook Saved Patti's garage (used to store business property) is destroyed by a fire. She decides

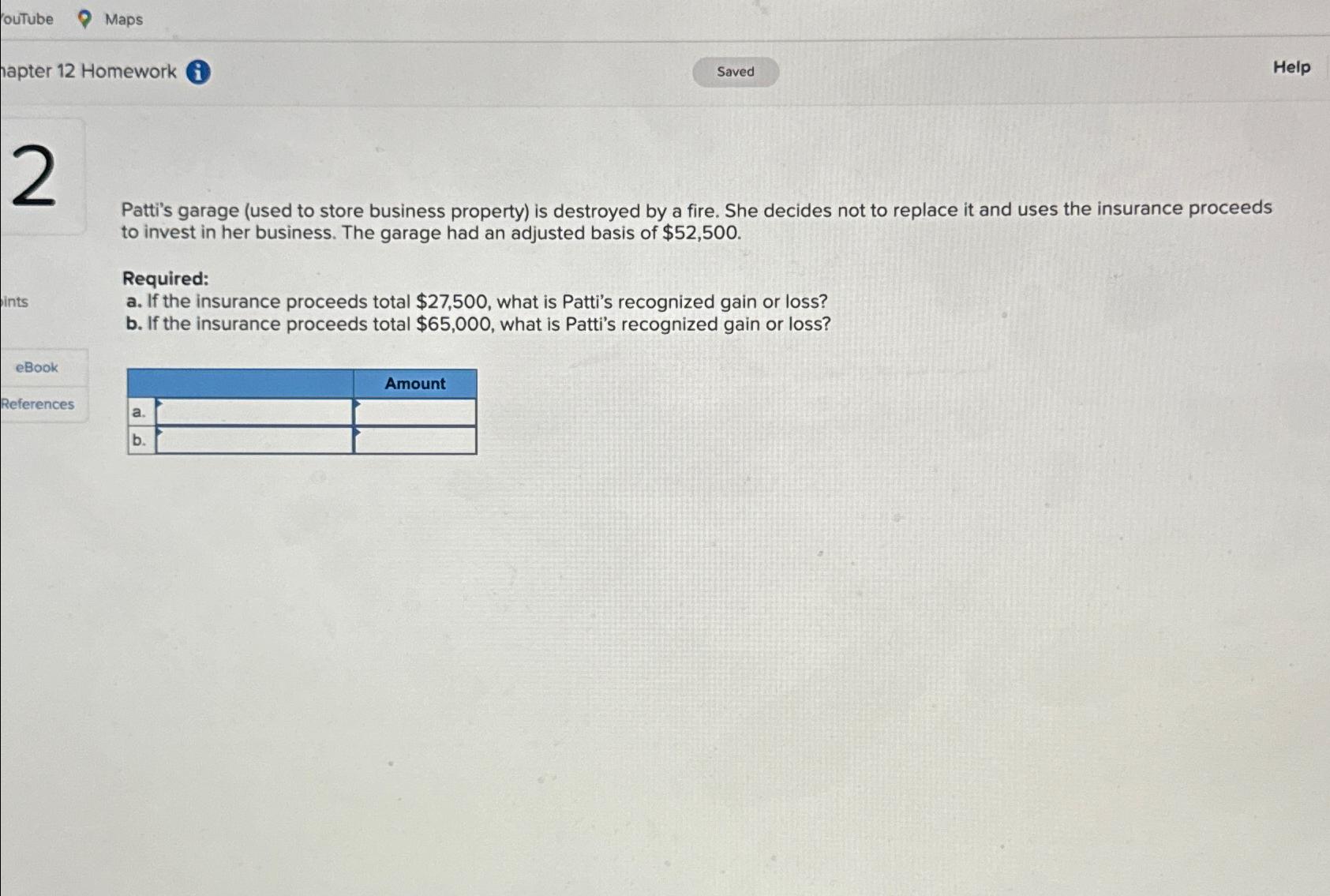

ouTube Maps hapter 12 Homework i 2 ints eBook Saved Patti's garage (used to store business property) is destroyed by a fire. She decides not to replace it and uses the insurance proceeds to invest in her business. The garage had an adjusted basis of $52,500. Required: a. If the insurance proceeds total $27,500, what is Patti's recognized gain or loss? b. If the insurance proceeds total $65,000, what is Patti's recognized gain or loss? References a. b. Amount Help

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts