Question: Over the past 10 years, the Hopewell Horizons Fund's worst year has been a 3.7% loss, and its best year has been an 8.1%

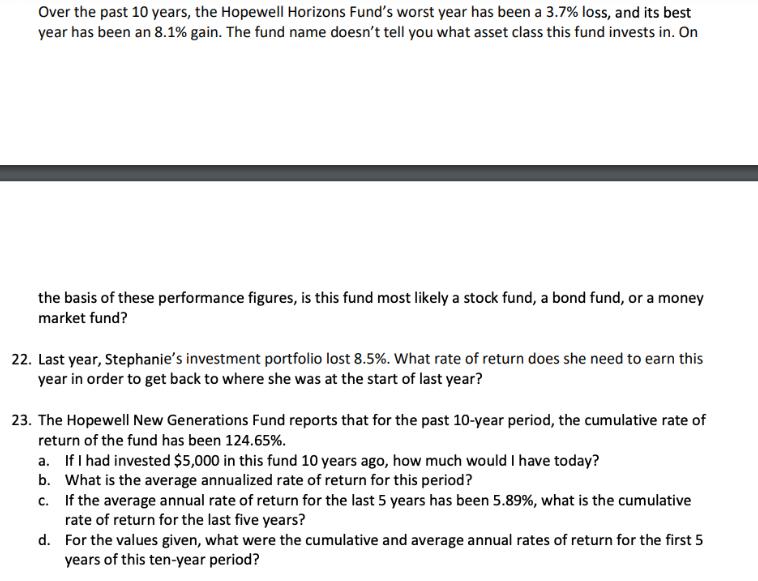

Over the past 10 years, the Hopewell Horizons Fund's worst year has been a 3.7% loss, and its best year has been an 8.1% gain. The fund name doesn't tell you what asset class this fund invests in. On the basis of these performance figures, is this fund most likely a stock fund, a bond fund, or a money market fund? 22. Last year, Stephanie's investment portfolio lost 8.5%. What rate of return does she need to earn this year in order to get back to where she was at the start of last year? 23. The Hopewell New Generations Fund reports that for the past 10-year period, the cumulative rate of return of the fund has been 124.65%. a. If I had invested $5,000 in this fund 10 years ago, how much would I have today? b. What is the average annualized rate of return for this period? c. If the average annual rate of return for the last 5 years has been 5.89%, what is the cumulative rate of return for the last five years? d. For the values given, what were the cumulative and average annual rates of return for the first 5 years of this ten-year period?

Step by Step Solution

3.28 Rating (154 Votes )

There are 3 Steps involved in it

22 To get back to where she was at the start of last year Stephanie needs to make up for the 85 loss from last year If x is the rate of return she nee... View full answer

Get step-by-step solutions from verified subject matter experts