Question: Over the past several weeks you have assembled a small stock portfolio via the purchase of small amounts of different company stocks. You know that

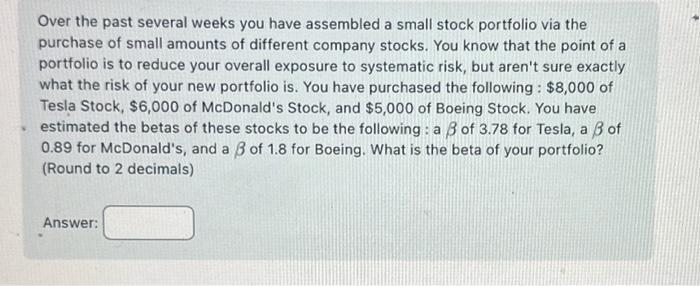

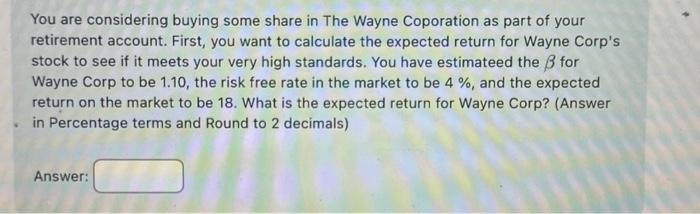

Over the past several weeks you have assembled a small stock portfolio via the purchase of small amounts of different company stocks. You know that the point of a portfolio is to reduce your overall exposure to systematic risk, but aren't sure exactly what the risk of your new portfolio is. You have purchased the following: $8,000 of Tesla Stock, $6,000 of McDonald's Stock, and $5,000 of Boeing Stock. You have estimated the betas of these stocks to be the following : a of 3.78 for Tesla, a of 0.89 for McDonald's, and a of 1.8 for Boeing. What is the beta of your portfolio? (Round to 2 decimals) Answer: You are considering buying some share in The Wayne Coporation as part of your retirement account. First, you want to calculate the expected return for Wayne Corp's stock to see if it meets your very high standards. You have estimateed the for Wayne Corp to be 1.10 , the risk free rate in the market to be 4%, and the expected return on the market to be 18 . What is the expected return for Wayne Corp? (Answer in Percentage terms and Round to 2 decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts