Question: P 2 - 1 2 Allocation schedule and computations ( excess cost over fair value ) Pop Corporation acquired a 7 0 percent interest in

P

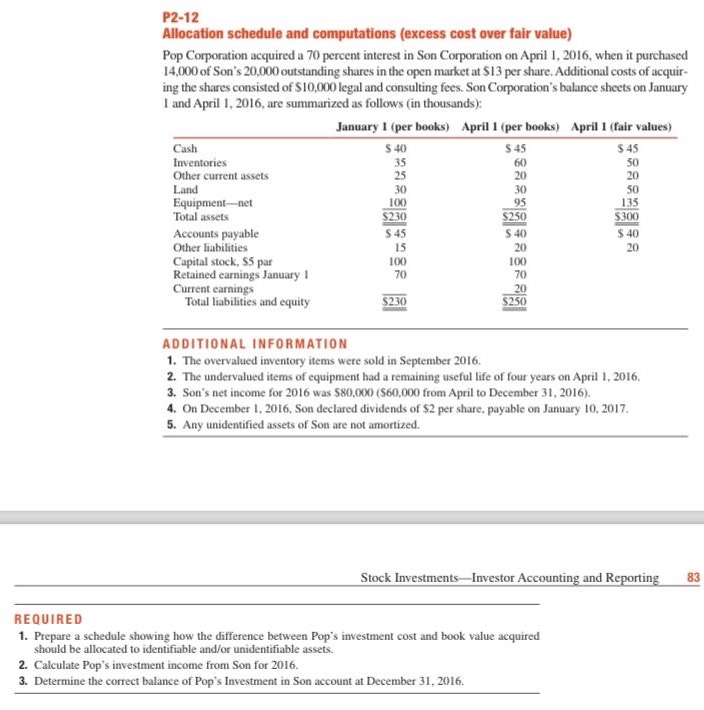

Allocation schedule and computations excess cost over fair value

Pop Corporation acquired a percent interest in Son Corporation on April when it purchased

of Son's outstanding shares in the open market at $ per share. Additional costs of acquir

ing the shares consisted of $ legal and consulting fees. Son Corporation's balance sheets on January

and April are summarized as follows in thousands:

ADDITIONAL INFORMATION

The overvalued inventory items were sold in September

The undervalued items of equipment had a remaining useful life of four years on April

Son's net income for was $ $ from April to December

On December Son declared dividends of $ per share, payable on January

Any unidentified assets of Son are not amortized.

REQUIRED

Prepare a schedule showing how the difference between Pop's investment cost and book value acquired

should be allocated to identifiable andor unidentifiable assets.

Calculate Pop's investment income from Son for

Determine the correct balance of Pop's Investment in Son account at December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock