Question: P 5 - 2 : Phipps Electronics Phipps manufactures circuit boards in Division Low in a country with a 3 0 percent income tax rate

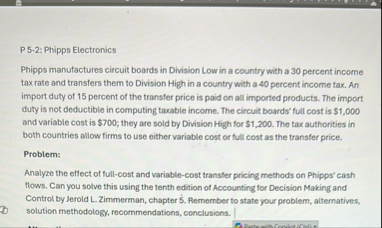

P : Phipps Electronics

Phipps manufactures circuit boards in Division Low in a country with a percent income tax rate and transfers them to Division High in a country with a percent income tax. An import duty of percent of the transfer price is paid on all imported products. The import duty is not deductible in computing taxable income. The circuit boards' full cost is $ and variable cost is $; they are sold by Division High for $ The tax authorities in both countries allow firms to use either variable cost or full cost as the transfer price.

Problem:

Analyze the effect of fullcost and variablecost transfer pricing methods on Phipps' cash flows. Can you solve this using the tenth edition of Accounting for Decision Making and Control by Jerold L Zimmerman, chapter Remember to state your problem, alternatives, solution methodology, recommendations, conclusions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock