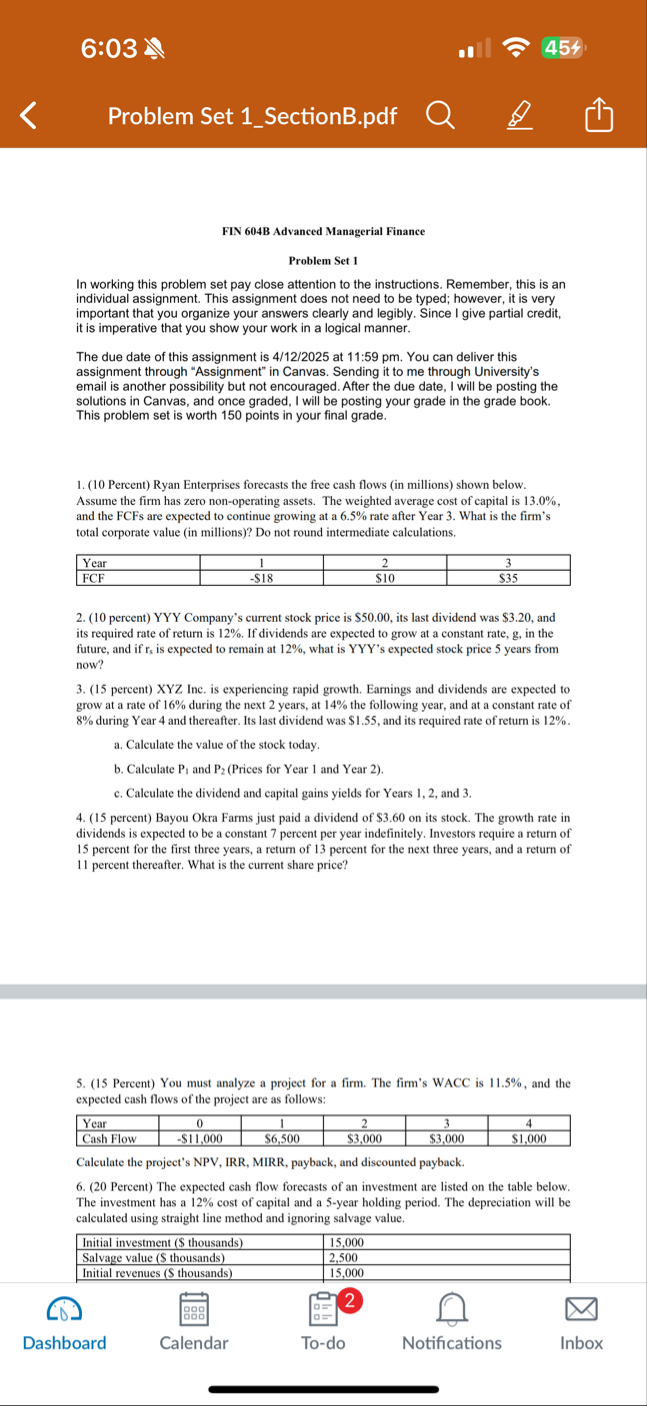

Question: P 6 : 0 4 4 5 4 Problem Set 1 _ SectionB.pdf grow at a rate of 1 6 % during the next 2

P

:

Problem Set SectionB.pdf

grow at a rate of during the next years, at the following year, and at a constant rate of during Year and thereafter. Its last dividend was $ and its required rate of return is

a Calculate the value of the stock today.

b Calculate and Prices for Year and Year

c Calculate the dividend and capital gains yields for Years and

percent Bayou Okra Farms just paid a dividend of $ on its stock. The growth rate in dividends is expected to be a constant percent per year indefinitely. Investors require a return of percent for the first three years, a return of percent for the next three years, and a return of percent thereafter. What is the current share price?

Percent You must analyze a project for a firm. The firm's WACC is and the expected cash flows of the project are as follows:

tableYearCash Flow,$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock