Question: p Can you please answer this question very quickly. i don't have much time. thank you 1. On January 1, 2020, ABC Company had the

p

Can you please answer this question very quickly. i don't have much time. thank you

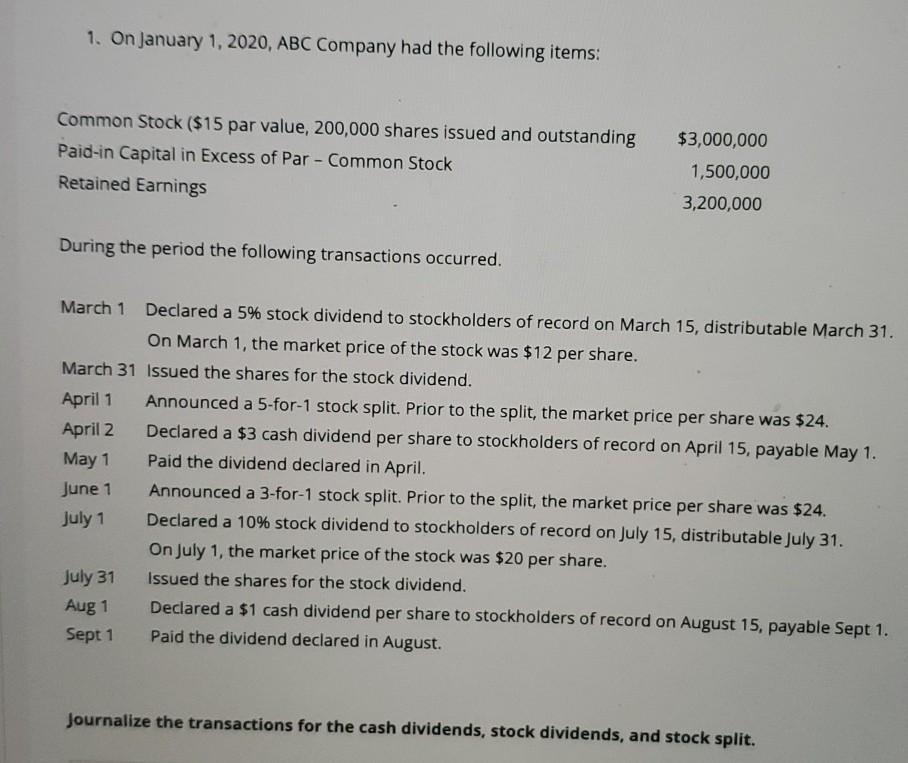

1. On January 1, 2020, ABC Company had the following items: Common Stock ($15 par value, 200,000 shares issued and outstanding Paid-in Capital in Excess of Par - Common Stock Retained Earnings $3,000,000 1,500,000 3,200,000 During the period the following transactions occurred. March 1 Declared a 5% stock dividend to stockholders of record on March 15, distributable March 31. On March 1, the market price of the stock was $12 per share. March 31 Issued the shares for the stock dividend. April 1 Announced a 5-for-1 stock split. Prior to the split, the market price per share was $24. April 2 Declared a $3 cash dividend per share to stockholders of record on April 15, payable May 1. May 1 Paid the dividend declared in April. June 1 Announced a 3-for-1 stock split. Prior to the split, the market price per share was $24. July 1 Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $20 per share. July 31 Issued the shares for the stock dividend. Aug 1 Declared a $1 cash dividend per share to stockholders of record on August 15, payable Sept 1. Sept 1 Paid the dividend declared in August. Journalize the transactions for the cash dividends, stock dividends, and stock split. 1. On January 1, 2020, ABC Company had the following items: Common Stock ($15 par value, 200,000 shares issued and outstanding Paid-in Capital in Excess of Par - Common Stock Retained Earnings $3,000,000 1,500,000 3,200,000 During the period the following transactions occurred. March 1 Declared a 5% stock dividend to stockholders of record on March 15, distributable March 31. On March 1, the market price of the stock was $12 per share. March 31 Issued the shares for the stock dividend. April 1 Announced a 5-for-1 stock split. Prior to the split, the market price per share was $24. April 2 Declared a $3 cash dividend per share to stockholders of record on April 15, payable May 1. May 1 Paid the dividend declared in April. June 1 Announced a 3-for-1 stock split. Prior to the split, the market price per share was $24. July 1 Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $20 per share. July 31 Issued the shares for the stock dividend. Aug 1 Declared a $1 cash dividend per share to stockholders of record on August 15, payable Sept 1. Sept 1 Paid the dividend declared in August. Journalize the transactions for the cash dividends, stock dividends, and stock split

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts