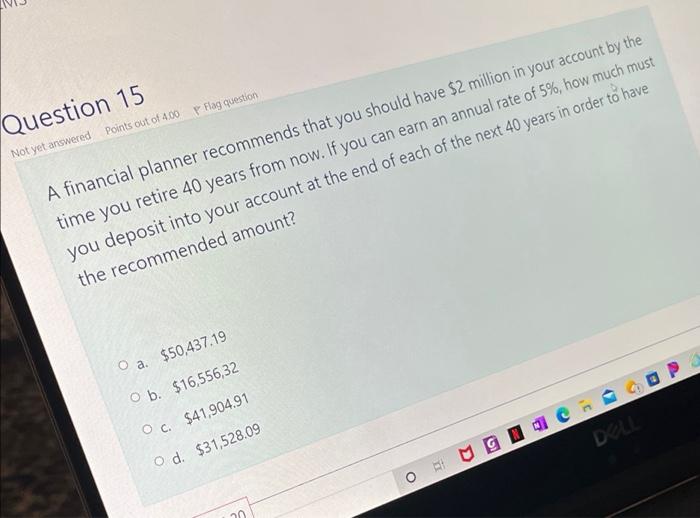

Question: P Flag question Question 15 Not yet answered Points out of 4.00 A financial planner recommends that you should have $2 million in your account

P Flag question Question 15 Not yet answered Points out of 4.00 A financial planner recommends that you should have $2 million in your account by the time you retire 40 years from now. If you can earn an annual rate of 5%, how much must you deposit into your account at the end of each of the next 40 years in order to have the recommended amount? O a $50,437.19 Ob. $16,556,32 Oc. $41,904.91 DEL O d. $31,528.09 IMGI

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock