Question: p please answer b,c,d,e . if it is possible write the role to understand a Your portfolio consists of S 200,000 invested in a stock

p please answer b,c,d,e . if it is possible write the role to understand

p please answer b,c,d,e . if it is possible write the role to understand

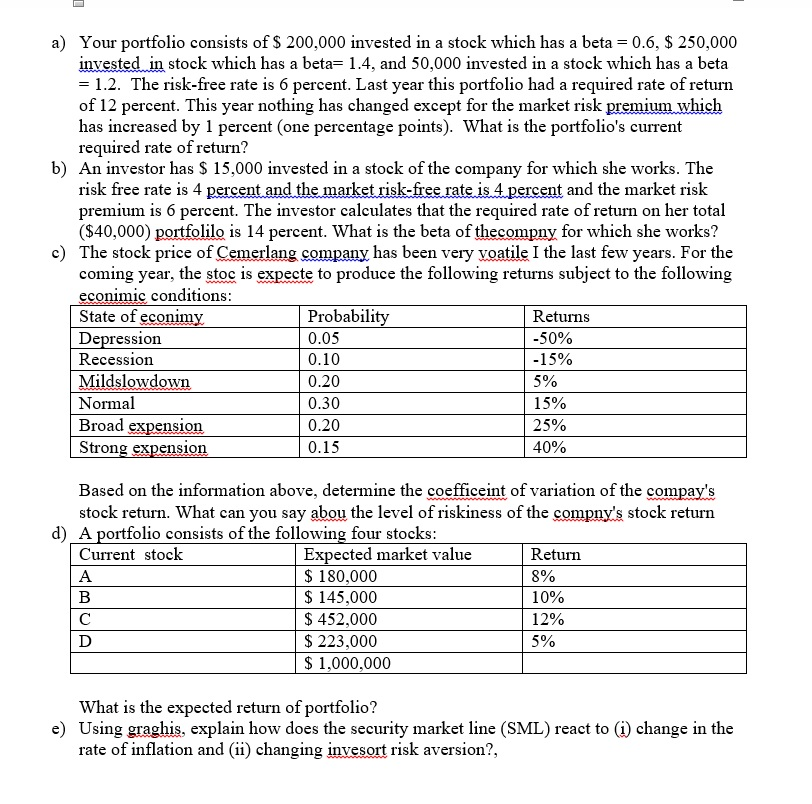

a Your portfolio consists of S 200,000 invested in a stock which has a beta-0.6, S 250,000 invested in stock which has a beta 1.4, and 50,000 invested in a stock which bas a beta - 1.2. The risk-free rate is 6 percent. Last year this portfolio had a required rate of return of 12 percent. This year nothing has changed except for the market risk premium which has increased by 1 percent (one percentage points). What is the portfolio's current required rate of return? b) Avestor has S 15,000 invested in a stock of the company for which she works. The risk free rate is 4 percent and the market risk-free rate is 4 percent and the market risk premium is 6 percent. The investor calculates that the required rate of return on her total ($40,000) portfolilo is 14 percent. What is the beta of thecompny for which she works? The stock price of Cemerlang company has been very voatile I the last few years. For the coming year, the stoc is expecte to produce the following retuns subject to the following econimic conditions State of ec c) Prob 0.05 50% 15% Recessiorn Mi Normal Broad 0.30 I 5% Based on the information above, determine the coefficeint of variation of the compay's stock return. What can you say abou the level of riskiness of the compny's stock return four stocks: lio consists of the Return 1040 5% Current stock Expected market value 180,000 145,000 S452,000 S 223,000 1,000,000 What is the expected return of portfolio? Using graghis, explain how does the security market line (SML) react to (i) change in the rate of inflation and (ii) changing invesort risk aversion? e)

Expert Answer

Anonymous answered this

Was this answer helpful?

0

0

417 answers

(a)

| Stock Name | Amount Invested | Weight (by value) in Total Portfolio | Stock Beta |

| Stock 1 | 200000 | (200000/500000) = 0.4 | 0.6 |

| Stock 2 | 250000 | (250000/500000) = 0.5 | 1.4 |

| Stock 3 | 50000 | (50000/500000) = 0.1 | 1.2 |

Total = $ 500000

Weighted Average Beta of the Portfolio = 0.4 x 0.6 + 0.5 x 1.4 + 0.1 x 1.2 = 1.06 = B(p)

Risk Free Rate = r(f) = 6%, Required Rate of Return = r(1) = 12%

Let Market Risk Premium r(m)

Assuming that CAPM holds

r(1) = r(f) + B(p) x r(m)

12 = 6 + 1.06 x r(m)

6 / 1.06 = r(m)

r(m) = 5.66%

This year the market risk premium has increase by 1 percentage point

This implies new market risk premium is r(m1) = r(m) +1 = 5.66 +1 =6.66%

Therefore, New (current) Required Rate of Return = r(f) + B(p) x r(m1) = 6 + 1.06 x 6.66 = 13.0596%

a) Your portfolio consists of S 200,000 invested in a stock which has a beta 0.6, $ 250,000 invested in stock which has a beta- 1.4, and 50,000 invested in a stock which has a beta 12. The risk-free rate is 6 percent. Last year this portfolio had a required rate of return of 12 percent. This year nothing has changed except for the market risk premium which has increased by 1 percent (one percentage points). What is the portfolio's current required rate of return? b) An investor has S 15,000 invested in a stock of the company for which she works. The and the market rsk risk free rate is 4 premium is 6 percent. The investor calculates that the required rate of return on her total ($40,000) portfolilo is 14 percent. What is the beta of thecompny for which she works? The stock price of Cemerlang company has been very voatile I the last few years. For the coming year, the stoe is expecte to produce the following returns subject to the following econimic conditions State of econim Depression Recession Mildslowdown Normal Broad expension Strong expension c) Probabilit 0.05 0.10 0.20 0.30 0.20 0.15 Returns -50% -15% 5% 15% 25% 40% Based on the information above, determine the coefficeint of variation of the compay's stock return. What can you say abou the level of riskiness of the compny's stock return d) A portfolio consists of the following four stocks: Expected market value $ 180,000 $ 145,000 $ 452,000 $ 223,000 $1.000.000 Current stock Return 8% 10% 12% 5% What is the expected return of portfolio? e) Using graghis, explain how does the security market line (SML) react to (i) change in the rate of inflation and (ii) changing invesort risk aversion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts