Question: p. Suppose Napoli decides to open a second location. The expansion would cost $3,000,000 and suppose that in the previous analysis they decided to issue

p. Suppose Napoli decides to open a second location. The expansion would cost

$3,000,000and suppose that in the previous analysis they decided to issue

$400,000in debt.\ Suppose they can finance the

$3,000,000with debt at a

9.5%rate or by issuing 187,500 common shares at

$16per share. What is their breakeven EBIT?\ If the new location is also expected to have EBIT of

$500,000per year and the standard deviation of Napoli's overall EBIT is

$200,000:\ i. What is the probability they will meet their breakeven EBIT?\ ii. What is the probability they will meet their interest payments?

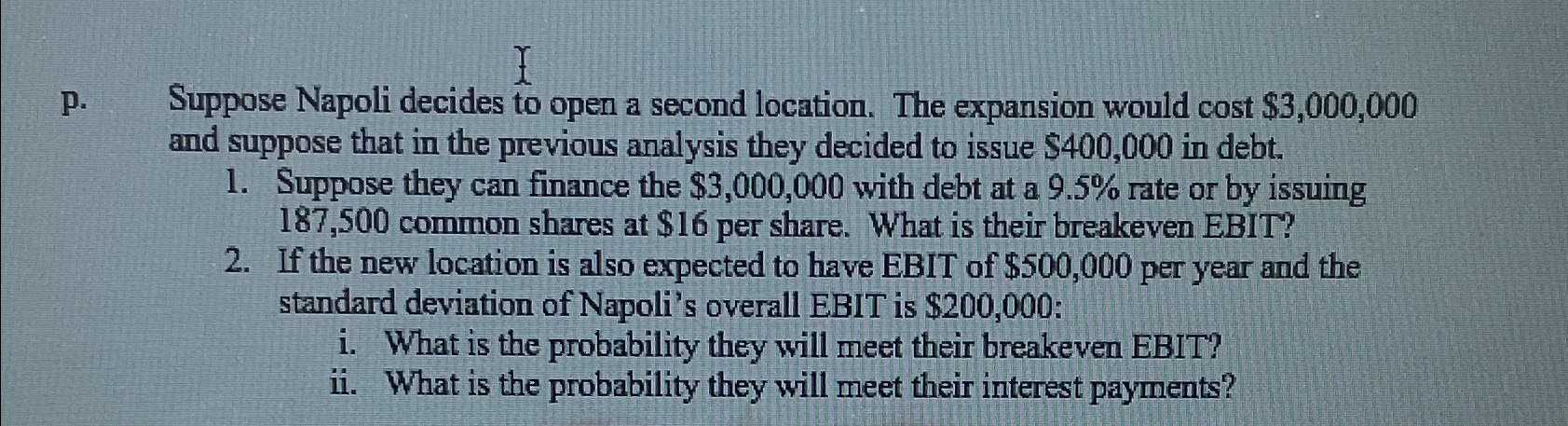

p. Suppose Napoli decides to open a second location. The expansion would cost $3,000,000 and suppose that in the previous analysis they decided to issue $400,000 in debt. 1. Suppose they can finance the $3,000,000 with debt at a 9.5% rate or by issuing 187,500 common shares at \$16 per share. What is their breakeven EBIT? 2. If the new location is also expected to have EBIT of $500,000 per year and the standard deviation of Napoli's overall EBIT is $200,000 : i. What is the probability they will meet their breakeven EBIT? ii. What is the probability they will meet their interest payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts