Question: A small motel with a small dining room has the following estimates for Year 0007: Sales Revenue $350,000 $150,000 35% of sales revenue Rooms

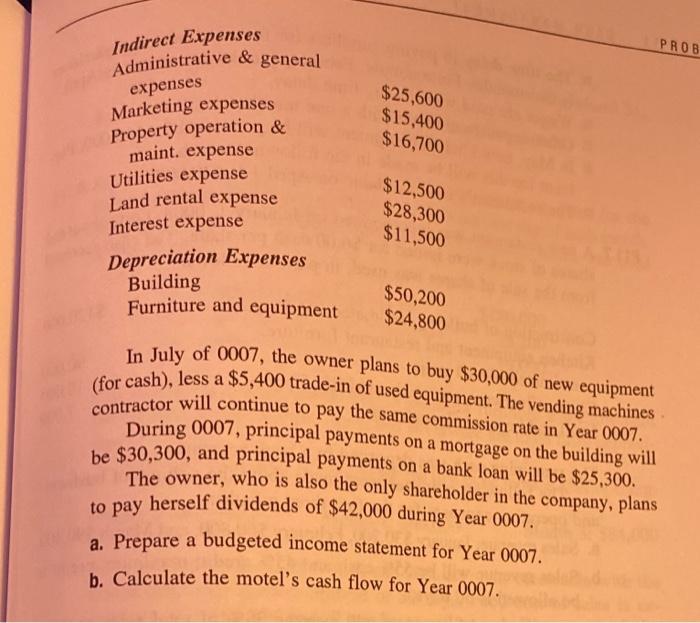

A small motel with a small dining room has the following estimates for Year 0007: Sales Revenue $350,000 $150,000 35% of sales revenue Rooms sales revenue Dining room sales revenue Cost of sales: dining room Direct expenses 25% of rooms sales revenue 40% of dining sales revenue 25% of rooms sales revenue 40% of dining room sales revenue 35% of dining room sales revenue Wages expense Rooms expense Dining room expenses Cost of sales: food Other operating expenses Rooms expense Dining room expense Other income 5% of rooms revenue 10% of dining room revenue $5,500 (vending machines) contractor will continue to pay the same commission rate in Year 0007. PROB Indirect Expenses Administrative & general $25,600 $15,400 $16,700 expenses Marketing expenses Property operation & maint. expense Utilities expense Land rental expense Interest expense $12,500 $28,300 $11,500 Depreciation Expenses Building Furniture and equipment $50,200 $24,800 To July of 0007, the owner plans to buy $30,000 of new equipment for cash), less a $5,400 trade-in of used equipment. The vending machines. During 0007, principal payments on a mortgage on the building will be $30,300, and principal payments on a bank loan will be $25,300. The owner, who is also the only shareholder in the company, plans to pay herself dividends of $42,000 during Year 0007. a. Prepare a budgeted income statement for Year 0007. h. Calculate the motel's cash flow for Year 0007.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

To solve this problem well go through the two main tasks preparing a budgeted income statement and calculating the cash flow for the year Lets break i... View full answer

Get step-by-step solutions from verified subject matter experts