Question: P12-2 Analyzing Comparative Financial Statements by Using Percentages and Selected Ratios LO12-5, 12-6, 12-9 Please do questions 2-f, 2-g, and 2-h The comparative financial statements

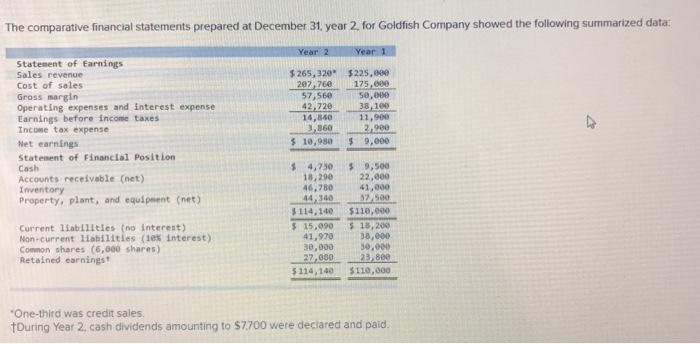

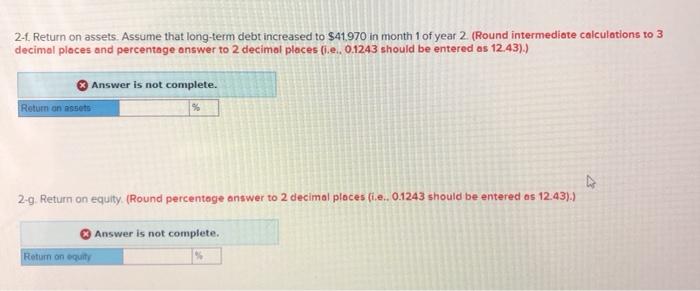

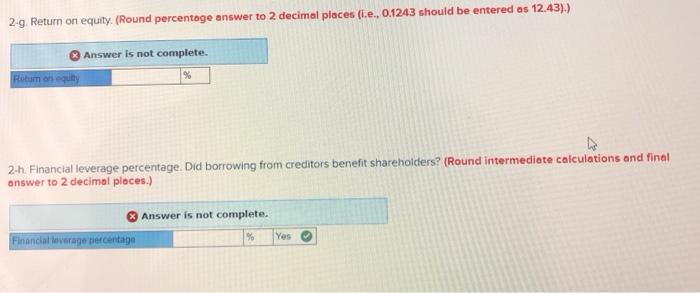

The comparative financial statements prepared at December 31, year 2 for Goldfish Company showed the following summarized data: Year 2 Year 1 Statement of Earnings Sales revenue Cost of sales Gross margin Operating expenses and Interest expense Earnings before income taxes Income tax expense Net earnings Statement of Financial Position Cash Accounts receivable (net) Inventory Property, plant, and equipment (net) $265, 320 207,760 57,560 42,720 14,840 3,860 $ 10,980 $225, 175,00 50,00 38,100 11,900 2.900 $ 9,000 $4,750 18,290 46,780 44.340 $ 114,140 $ 15,090 41,970 30,000 27,000 $ 114,140 $ 9,500 22,000 41.000 32,500 $110,000 $ 15,200 38,000 30.000 23,800 $110,000 Current liabilities (no interest) Non-current liabilities (10% Interest) Common shares (6,000 shares) Retained carningst "One-third was credit sales Touring Year 2, cash dividends amounting to $7700 were declared and paid. 2-1. Return on assets. Assume that long-term debt increased to $41970 in month 1 of year 2. (Round intermediate calculations to 3 decimal places and percentage answer to 2 decimal places (ie, 0.1243 should be entered as 12.43).) Answer is not complete. Return on assets % 2-9. Return on equity. (Round percentage answer to 2 decimal places fi.e., 0.1243 should be entered os 12.43).) Answer is not complete. Return on equity 2-9. Return on equity. (Round percentage answer to 2 decimal places (.e., 0.1243 should be entered as 12.43).) Answer is not complete. Robum on equity % 2-h. Financial leverage percentage. Did borrowing from creditors benefit shareholders? (Round intermediate calculations and final answer to 2 decimal places.) Answer is not complete. Financial leverage percentage % Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts