Question: P12-56A Evaluate an investment using all four methods (Learning objectives 2 & 4) Splash World is considering purchasing a water park in Charlotte, North Carolina,

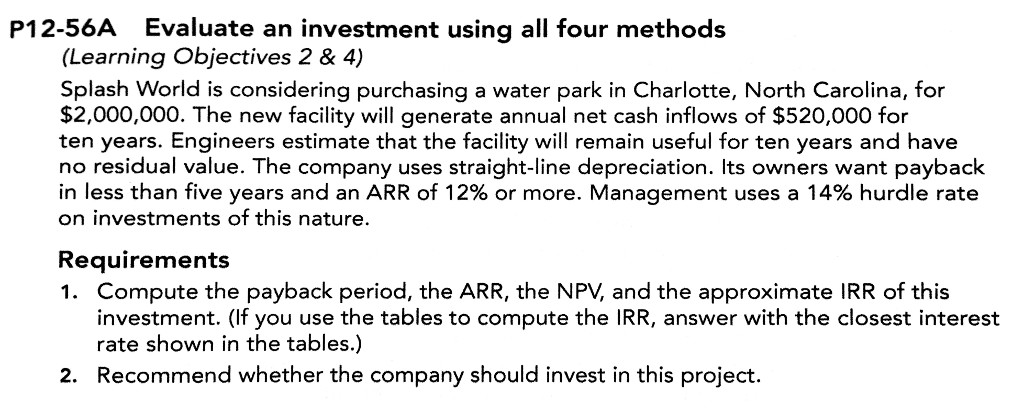

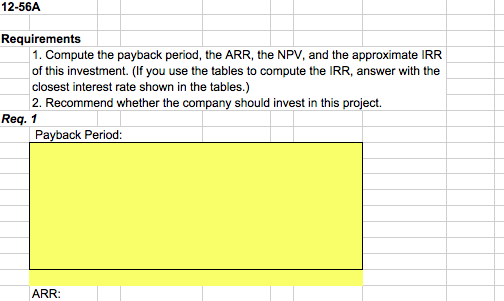

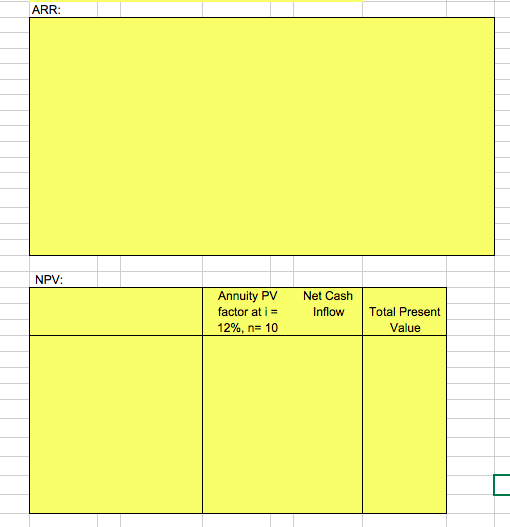

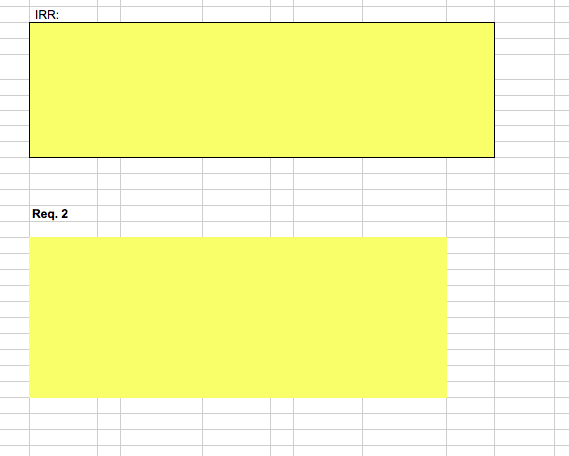

P12-56A Evaluate an investment using all four methods (Learning objectives 2 & 4) Splash World is considering purchasing a water park in Charlotte, North Carolina, for $2,000,000. The new facility will generate annual net cash inflows of $520,000 for ten years. Engineers estimate that the facility will remain useful for ten years and have no residual value. The company uses straight-line depreciation. Its owners want payback in less than five years and an ARR of 12% or more. Management uses a 14% hurdle rate on investments of this nature. Requirements investment. (If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables.) 2. Recommend whether the company should invest in this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts