Question: p14.1 Measuring Market Multiple Numerators-Multiple Company: Below, we present an income statement and balance sheet for the Multiple Company. The company's debt and preferred stock

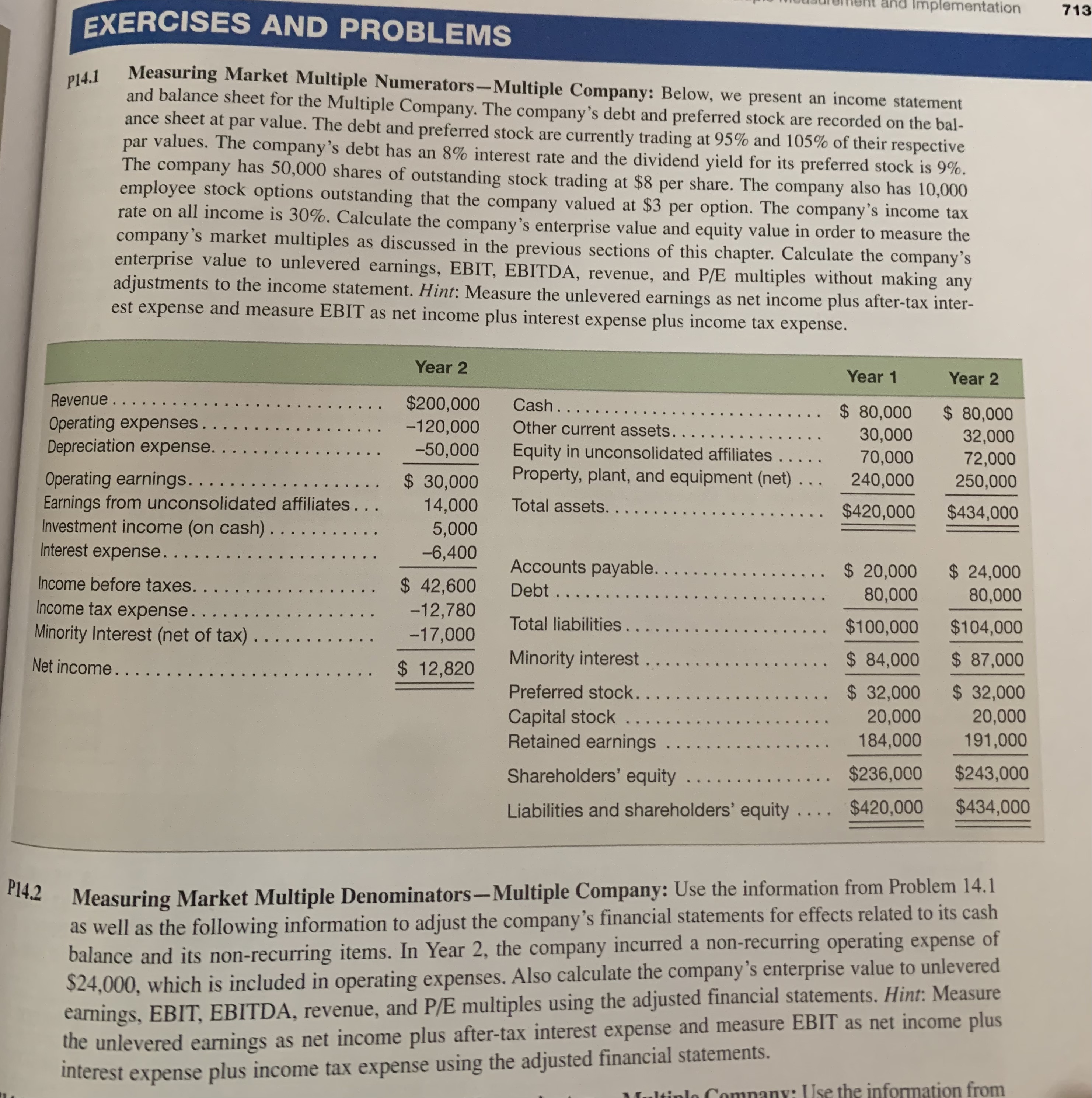

p14.1 Measuring Market Multiple Numerators-Multiple Company: Below, we present an income statement and balance sheet for the Multiple Company. The company's debt and preferred stock are recorded on the balance sheet at par value. The debt and preferred stock are currently trading at \95 and \105 of their respective par values. The company's debt has an \8 interest rate and the dividend yield for its preferred stock is \9. The company has 50,000 shares of outstanding stock trading at \\( \\$ 8 \\) per share. The company also has 10,000 employee stock options outstanding that the company valued at \\( \\$ 3 \\) per option. The company's income tax rate on all income is \30. Calculate the company's enterprise value and equity value in order to measure the company's market multiples as discussed in the previous sections of this chapter. Calculate the company's enterprise value to unlevered earnings, EBIT, EBITDA, revenue, and P/E multiples without making any adjustments to the income statement. Hint: Measure the unlevered earnings as net income plus after-tax interest expense and measure EBIT as net income plus interest expense plus income tax expense. 1.2 Measuring Market Multiple Denominators-Multiple Company: Use the information from Problem 14.1 as well as the following information to adjust the company's financial statements for effects related to its cash balance and its non-recurring items. In Year 2, the company incurred a non-recurring operating expense of \\( \\$ 24,000 \\), which is included in operating expenses. Also calculate the company's enterprise value to unlevered earnings, EBIT, EBITDA, revenue, and P/E multiples using the adjusted financial statements. Hint: Measure the unlevered earnings as net income plus after-tax interest expense and measure EBIT as net income plus interest expense plus income tax expense using the adjusted financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts