Question: P17-6 (similar to) Question Help o (Forecasting financing needs) The current balance sheet of the Murphy Forklifts, Inc., is as follows: E. Murphy had sales

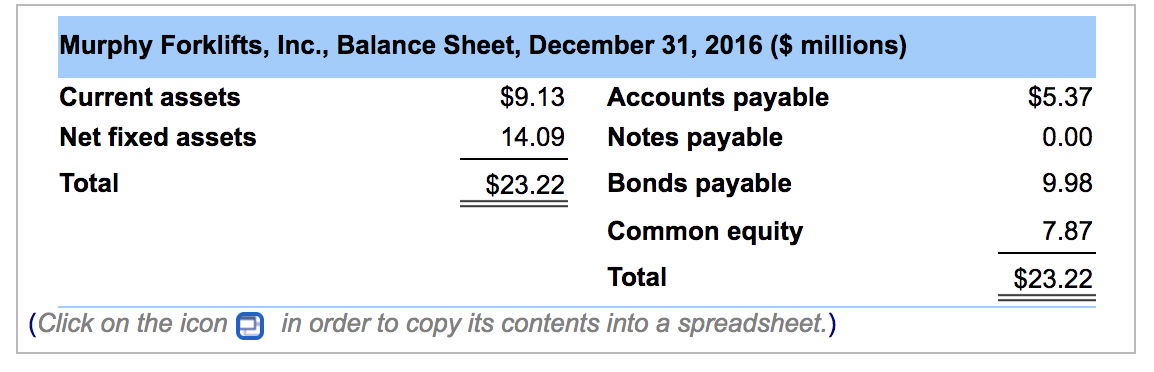

P17-6 (similar to) Question Help o (Forecasting financing needs) The current balance sheet of the Murphy Forklifts, Inc., is as follows: E. Murphy had sales for the year ended December 31, 2016, of $50.04 million. The firm follows a policy of paying all net earnings out to its common stockholders in cash dividends. Thus, Murphy generates no funds from its earnings that can be used to expand its operations. (Assume that depreciation expense is equal to the cost of replacing worn-out assets.). Hint. Make sure to round all intermediate calculations to at least five decimal places. a. If Murphy anticipates sales of $99.11 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage of sales. Use notes payable as a balancing entry. b. How much new financing will Murphy need next year? c. What are the limitations of the percent-of-sales forecast method? Discuss briefly. (Round to the nearest dollar.) Murphy Forklifts, Inc. Pro Forma Balance Sheet as of 12/31/17 Current assets $ Net fixed assets Total assets $ Accounts payable Notes payable Bonds payable Common equity Total liabilities and common equity $ Enter any number in the edit fields and then click Check Answer. ? parts remaining Clear All Check Answer Murphy Forklifts, Inc., Balance Sheet, December 31, 2016 ($ millions) Current assets Net fixed assets $9.13 14.09 $5.37 0.00 Accounts payable Notes payable Bonds payable Common equity Total $23.22 9.98 7.87 Total $23.22 (Click on the icone in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts