Question: P2 (15 pts) Consider two call options on the same stock with the same expiration date. Call option #1 has a strike price of X1

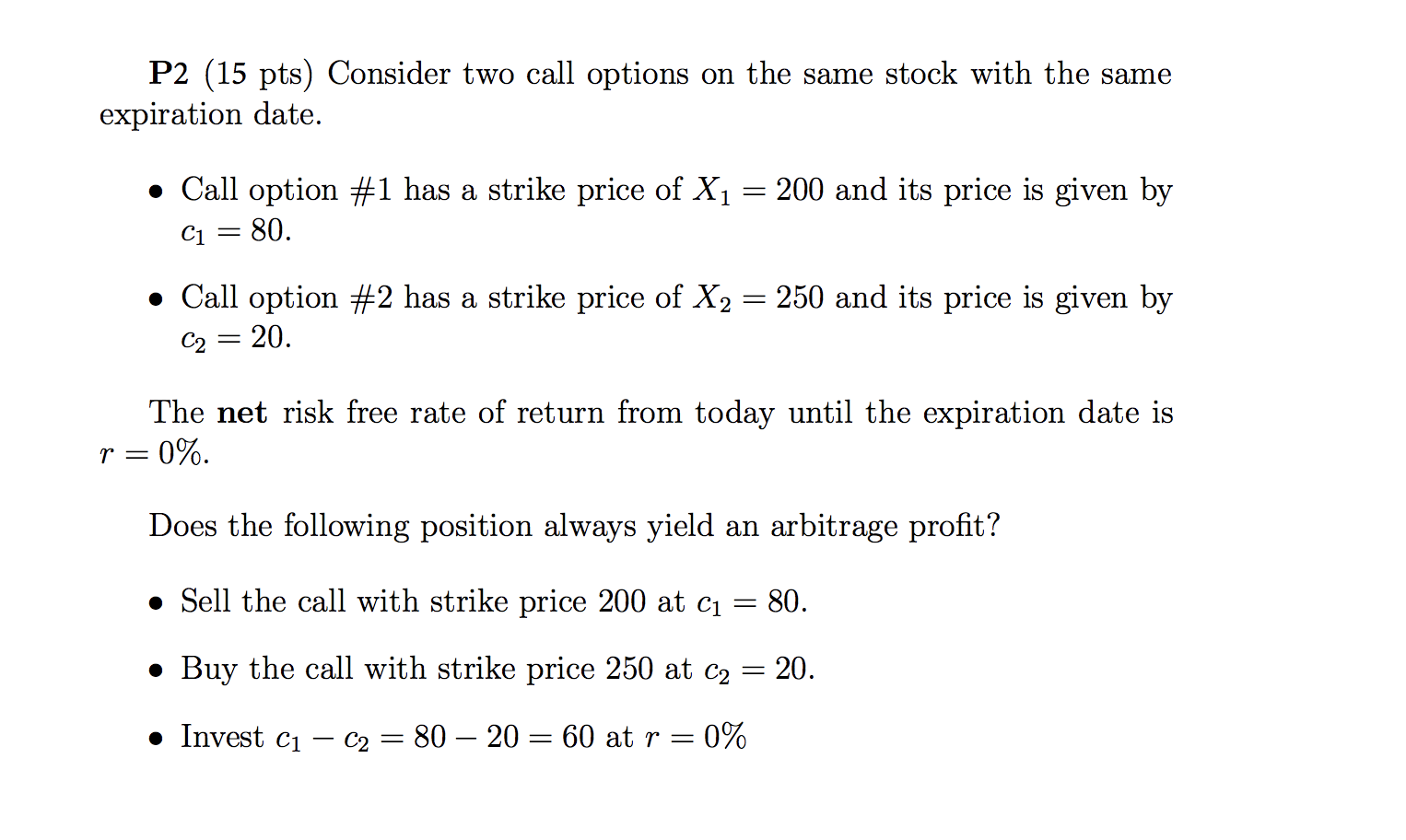

P2 (15 pts) Consider two call options on the same stock with the same expiration date. Call option #1 has a strike price of X1 = 200 and its price is given by Ci = 80. Call option #2 has a strike price of X2 = 250 and its price is given by C2 = 20. The net risk free rate of return from today until the expiration date is p=0%. Does the following position always yield an arbitrage profit? Sell the call with strike price 200 at ci = 80. Buy the call with strike price 250 at C2 20. Invest Ci C2 = 80 20 = 60 at r = -0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts