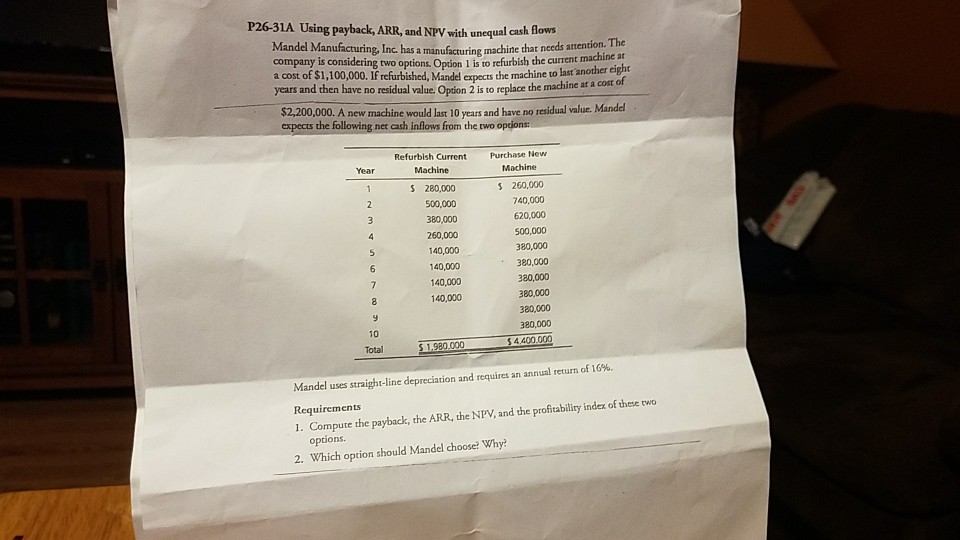

Question: P26-31A Using payback, ARR, and NPV with unequal c Mandel Manufacturing, Inc has a manufcturing machine that needs attention. The company is considering two options.

P26-31A Using payback, ARR, and NPV with unequal c Mandel Manufacturing, Inc has a manufcturing machine that needs attention. The company is considering two options. Opion 1 is to refurbish the current machine at a cost of $1,100,000. If refurbished, Mandel expects years and then have no residual value. Option 2 is to replace the machine at a cost of the machine to last another eight $2,200,000. A new machine would last 10 years and have no residual value. Mandel expects the following net cash inflows from the two opions: Refurbish Current Purhae New Year Machine S 280,000 500,000 380,000 260,000 40,000 140,000 40,000 40,000 s 260,000 740,000 620,000 500,000 380,000 380,000 380,000 380,000 380,000 80,000 4.400.000 Total 1,980,000 Mandel uses straight-line depreciation and requires an annual return of 16%, Requirements I. Compute the payback, the ARR, the NPV, and the profitability index of these two 2. Which option should Mandel choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts