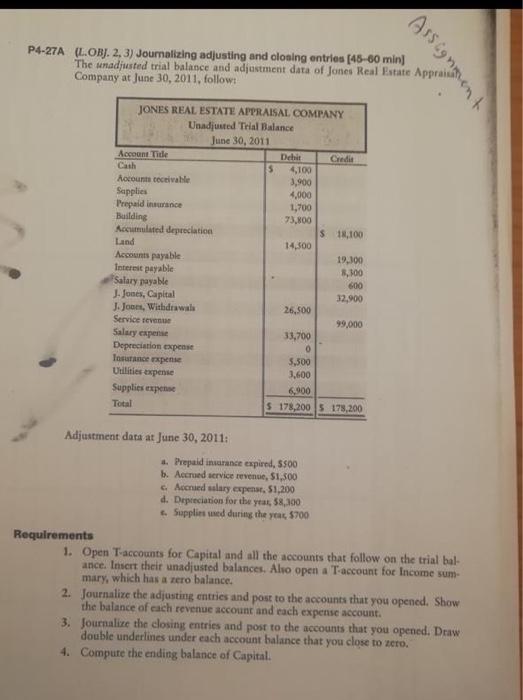

Question: P4-27A (L.OBJ. 2, 3) Journalizing adjusting and closing entries (45-60 min) The unadjusted trial balance and adjustment data of Jones Real Estate Company at June

P4-27A (L.OBJ. 2, 3) Journalizing adjusting and closing entries (45-60 min) The unadjusted trial balance and adjustment data of Jones Real Estate Company at June 30, 2011, follow Assignment JONES REAL ESTATE APPRAISAL COMPANY Unadjusted Trial Balance June 30, 2011 Account Title Dehit Credi Cash 5 4,100 Rocount ceceivable 3,900 Sapplies 4,000 Prepaid inance 1,700 Building 73,800 Acumulated depreciation $1,100 Land 14.500 Accounts payable 19,300 Interest payable 3,100 Salary payable 600 J. Jones, Capital 32,900 J.Joon, Withdrawal 26.500 Service teve 99,000 Salary expert 33,700 Depreciation expense 0 Toute pense 5,500 3.600 Supplies expense Total $ 178,200 $ 179,200 Utilities Expense 6.900 Adjustment data at June 30, 2011: 1. Prepaid insurance expired, 5500 b. Accrued service revenue, 51,500 Accred salary expens, 51,200 d. Depreciation for the year, 58,300 Supplies wed during the year, 5700 Requirements 1. Open T-accounts for Capital and all the accounts that follow on the trial bal- ance. Insert their unadjusted balances. Also open a T-account for Income sum- mary, which has a zero balance. 2. Journalize the adjusting entries and post to the accounts that you opened. Show the balance of each revenue account and each expense account. 3. Journalize the closing entries and post to the accounts that you opened. Draw double underlines under each account balance that you close to zero. 4. Compute the ending balance of Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts