Question: P4/5 plz answer fast thank you ! Builtrite is considering purchasing a new machine that would cost $75,000 and the machine would be depreciated (straight

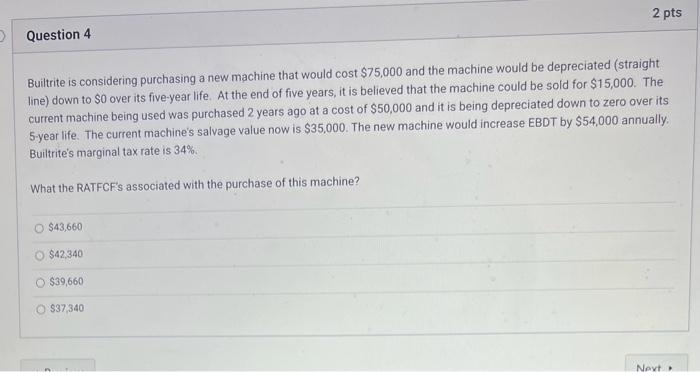

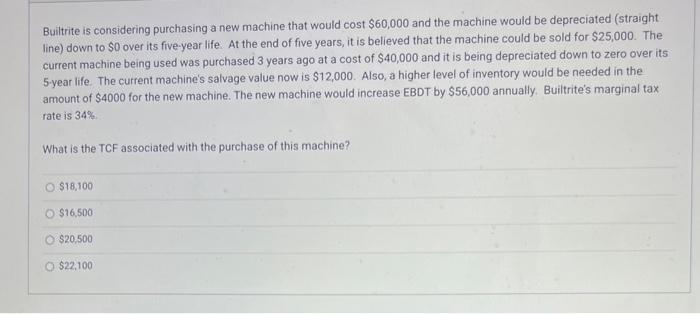

Builtrite is considering purchasing a new machine that would cost $75,000 and the machine would be depreciated (straight line) down to $0 over its five-year life. At the end of five years, it is believed that the machine could be sold for $15,000. The current machine being used was purchased 2 years ago at a cost of $50,000 and it is being depreciated down to zero over its 5 year life. The current machine's salvage value now is $35,000. The new machine would increase EBDT by $54,000 annually. Builtrite's marginal tax rate is 34%. What the RATFCF's associated with the purchase of this machine? $43,660 $42,340 $39,660 $37,340 Builtrite is considering purchasing a new machine that would cost $60,000 and the machine would be depreciated (straight line) down to $0 over its five-year life. At the end of five years, it is believed that the machine could be sold for $25,000. The current machine being used was purchased 3 years ago at a cost of $40,000 and it is being depreciated down to zero over its 5.year life. The current machine's salvage value now is \$12,000. Also, a higher level of inventory would be needed in the amount of $4000 for the new machine. The new machine would increase EBDT by $56,000 annually. Builtrite's marginal tax rate is 34%. What is the TCF associated with the purchase of this machine? $18,100 $16,500 $20,500 $22,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts