Question: P6 -5 Determining Bad Debt Expense Based on Aging Analysis Valhalla Equipment Company uses the aging approach h to estimate bad debt expense at the

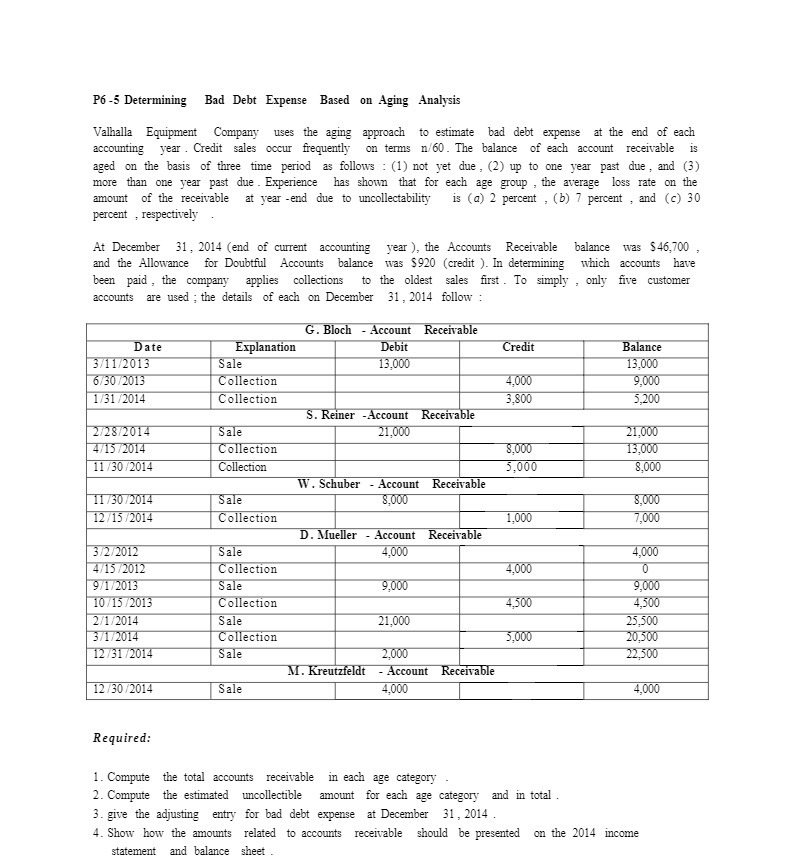

P6 -5 Determining Bad Debt Expense Based on Aging Analysis Valhalla Equipment Company uses the aging approach h to estimate bad debt expense at the end of each accounting year . Credit sales occur frequently on terms n/60. The balance of each account receivable aged on the basis of three time period as follows : (1) not yet due , (2) up to one year past due , and (3) more than one year past due . Experience has shown that for each age group , the average loss rate on the amount of the receivable at year -end due to uncollectability is (a) 2 percent , (b) 7 percent , and (c) 30 percent , respectively At December 31, 2014 (end of current accounting year ), the Accounts Receivable balance was $46,700 and the Allowance for Doubtful Accounts b balance was $920 (credit ). In determining which accounts have been paid , the company applies collections to the oldest sales first . To simply , only five customer accounts are used ; the details of each on December 31, 2014 follow : G. Bloch - Account Receivable Date Explanation Debit Credit Balance 3/11/2013 Sale 13,000 13,000 6/30/2013 Collection 4,000 9,000 1/31 /2014 Collection 3.800 5,200 S. Reiner -Account Receivable 2/28/2014 Sale 21,000 21,000 4/15 /2014 Collection 8,000 13,00 11 /30 /2014 Collection 5,000 3.00 W. Schuber - Account Receivable T1 730/2014 Sale 8.000 8,000 12/15 /2014 Collection 1,000 7,000 D. Mueller - Account Receivable 3/2/2012 Sale 4,000 4,000 4/15/2012 Collection 4,000 0 9/1/2013 Sale 9,000 9,000 10/15 /2013 Collection 4,500 4,300 2/1/2014 Sale 21.000 25,500 371/2012 Collection 3.000 20,500 12/31 /2014 Sale 2,000 22.500 M. Kreutzfeldt - Account Receivable 12 /30 /2014 Sale 4,000 4,000 Required: 1. Compute the total accounts receivable in each age category . 2. Compute the estimated u uncollectible amount for each age category and in total 3. give the adjusting entry for bad debt expense at December 31 , 2014 4. Show how the amounts related to accounts receivable should be presented on the 2014 income statement and balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts