Question: P6-72B. (Learning Objectives 2, 3: Applying the different inventory costing methods perpetual system) The records of Bryan Aviation include the following accounts for inventory of

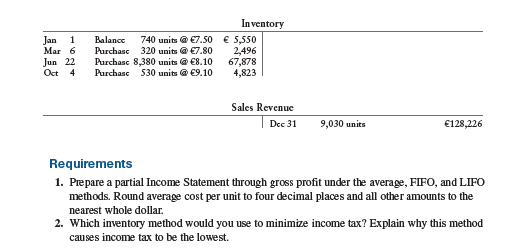

P6-72B. (Learning Objectives 2, 3: Applying the different inventory costing methods perpetual system) The records of Bryan Aviation include the following accounts for inventory of aviation fuel at December 31 of the current year: Jan 1 Mar 6 Jun 22 Oct 4 Balance 740 units @ 7.50 Purchase 320 units @ 7.80 Purchasc 8,380 units @ 8.10 Purchasc 530 units @ 9.10 Inventory 5,550 2.496 67,878 4,823 Sales Revenue | Dcc 319,030 units 128,226 Requirements 1. Prepare a partial Income Statement through gross profit under the average, FIFO, and LIFO methods. Round average cost per unit to four decimal places and all other amounts to the nearest whole dollar. 2. Which inventory method would you use to minimize income tax? Explain why this method causes income tax to be the lowest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts