Question: P6.8 A deviation from covered interest arbitrage is uncovered interest arbitrage (UIA), wherein investors borrow in countries and currencies exhibiting relatively low interest rates and

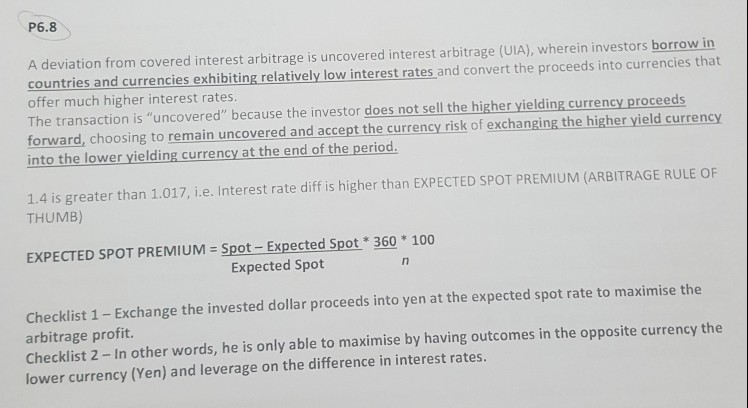

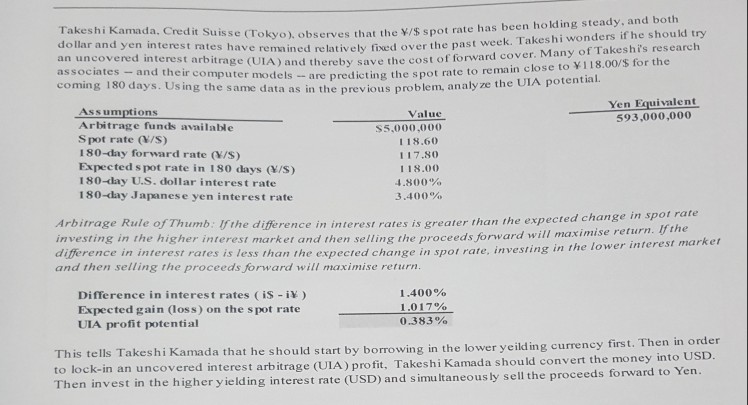

P6.8 A deviation from covered interest arbitrage is uncovered interest arbitrage (UIA), wherein investors borrow in countries and currencies exhibiting relatively low interest rates and convert the proceeds into currencies that offer much higher interest rates. The transaction is "uncovered" because the investor does not sell the higher yielding currency proceeds forward, choosing to remain uncovered and accept the currency risk of exchanging the higher yield currency into the lower yielding currency at the end of the period 1.4 is greater than 1.017, i.e. Interest rate diff is higher than EXPECTED SPOT PREMIUM (ARBITRAGE RULE OF THUMB) EXPECTED SPOT PREMIUM = Spot-Expected Spot * 360 * 100 Expected Spot Checklist 1 - Exchange the invested dollar proceeds into yen at the expected spot rate to maximise the arbitrage profit. Checklist 2- In other words, he is only able to maximise by having outcomes in the opposite currency the lower currency (Yen) and leverage on the difference in interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts