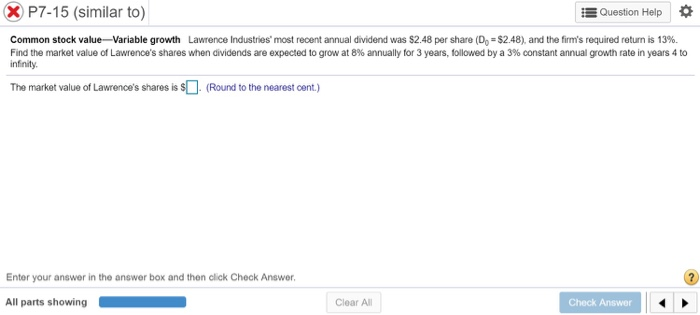

Question: P7-15 (similar to) Question Help Common stock value Variable growth Lawrence Industries most recent annual dividend was S2.48 per share (D-$2.48 and the firm's required

P7-15 (similar to) Question Help Common stock value Variable growth Lawrence Industries most recent annual dividend was S2.48 per share (D-$2.48 and the firm's required return is 13%. Find the market value of Lawrence's shares when dividends are expected to grow at 8% annually for 3 years, followed by a 3% constant annual growth rate in years 4 to infinity. The market value of Lawrence's shares is s(Round to the nearest cent) Enter your answer in the answer box and then click Check Answer. All parts showing Clear All Check

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock